![]()

![]()

We are thrilled to partner with Ryan Williams to publish our 2018 U.S. Food & Beverage Startup Investment Report. A reformed banker, Ryan now leads finance and special projects for RISE Brewing Co., an award winning nitro cold brew coffee brand. On the side, he likes techno, backpacking, helping other food entrepreneurs, and long walks through the grocery store.

$1.45+ Billion Invested Across 247 Food & Beverage Deals

With acquisitions on the rise and more capital flowing into the industry, 2018 was another great year for U.S. based food and beverage startups. The year saw $1.45 billion invested across 200 disclosed deals, according to our research. In total, there were 247 reported financings in 2018. The largest check size of the year was for $114 million to Impossible Foods, with a median check size of $2.4 million (up from $3.9 million in 2017) and average check size of $7.3 million (up from $8.9 million in 2017). Despite a slight decline from 65 deals in 2017, M&A remained strong with 59 branded food and beverage deals closed in 2018, according to data compiled by Houlihan Lokey.

Our Investment Report examines U.S. based food and beverage investor trends, investment trends by category, and overall industry trends from 2018. Additionally, the report concludes with a detailed overview of notable exists and investments.

Please note, we used new data sources for 2017 and 2018 figures. Please do not refer to 2017 figures in our prior report for comparison purposes, as updated data alters prior year results. Improvements to our tracking and methodology allowed us to better track deal activity in 2018 than the year prior, allowing us to catch some of the smaller deals that are less widely publicized. We also began tracking three new categories, including CBD & THC, meal kits, and supplements.

The database underlying this report relies on a variety of public sources of information such as industry publications, SEC filings, Crunchbase, newsletters, and social media to track investments made by by angel investors, incubators, venture capital firms, and private equity firms. While a best effort is made, no guarantee is given regarding its comprehensiveness or accuracy. The database covers the U.S. branded food and beverage category, which includes in-market products sold to consumers through e-commerce or traditional retail channels.

If you enjoy this free report, please subscribe to our newsletter

and tag us #foodtech @ryanstuartwill @foodtechconnect

Report Content

Click on the links below to easily navigate this report.

1. Investor Trends

2. Food & Beverage Investment Category Data & Trends

3. Notable 2018 CPG Trends

4. Notable Exits

5. Complete List of 2018 Food & Beverage Investments

Investor Trends

![]()

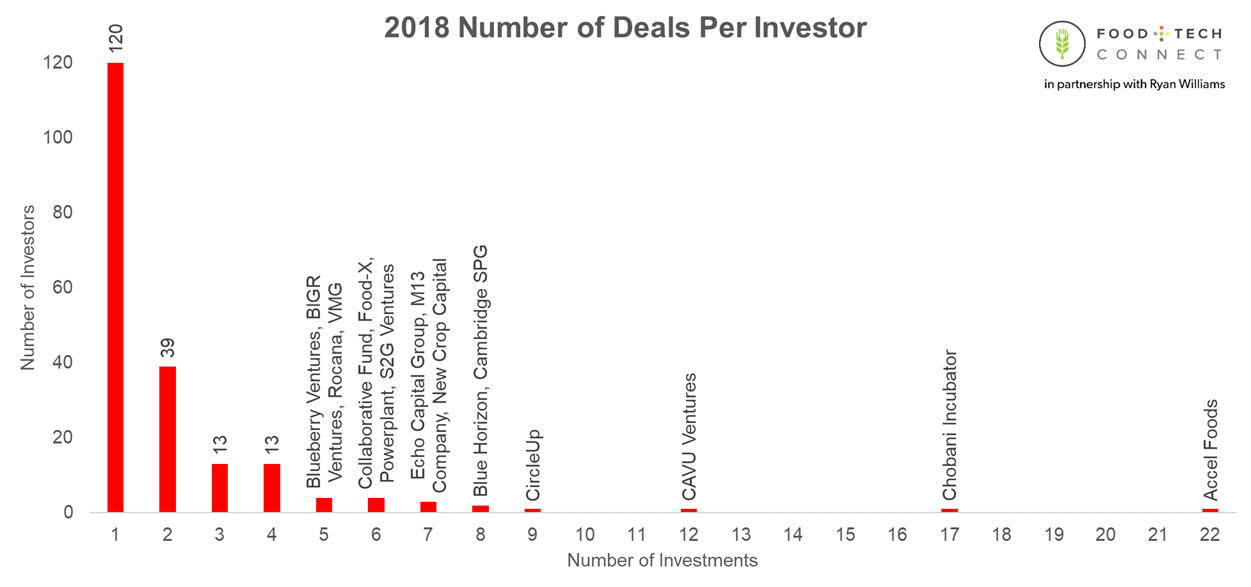

On the investing side, 2018 was more focused on maturation than innovation. Last year saw the full scale arrival of traditional tech investors, the advent of data-driven funds such as CircleUp, and the emergence of mega rounds backing category leaders. These strategies continued through 2018, albeit directed at the ever widening scope of exciting categories and trends, from plant-based to CBD.

As more investors have flocked to food, capital providers have sought to differentiate their dollars. CircleUp, for example, notes on its website: “We now provide not only access to capital, but also introductions to retailers and strategics, as well as actionable insights, powered by our machine learning platform, Helio.” Similarly, influencer-centric Wild Ventures specializes in online distribution and sales. It has assembled an investor syndicate of wellness influencers that can help drive direct sales. Bringing something unique to the table is becoming increasingly important and VCs are seeking to establish their value-add.

Some investors are generalists, investing in a wide variety of brands. One of the most active firms this year, AccelFoods, participated in 17 deals ranging from bone broth (Bonafide Provisions) to cold brew coffee (Wandering Bear). Cambridge SPG was also lively, closing seven deals in brands such as Vive Organic, Tosi Health, and Once Upon a Farm. More frequent participation helps firms learn faster, diversify their risk, and double down on category winners.

While other investors target specific sectors, particularly when it comes to plant-based. New Crop Capital, Powerplant Ventures, and Stray Dog Capital have all built impressive portfolios by focusing exclusively on the industry’s continued embrace of alternatives to meat, seafood, and dairy. Other niche focused investors include The DTX Company, Elizabeth Street Ventures, and Outbound Ventures, which have concentrated on e-commerce standouts such as Dirty Lemon, RISE Brewing Co., Ark Foods, and spero.

Just as interesting as who came to the table in 2018 is who didn’t. Whereas tech focused VC firms made many showings in 2017, very few of the big names closed new deals in 2018. Neither Accel, Andreessen Horowitz, Box Group, First Round Capital, Greycroft nor GV did a food related deal. Only Horizons Ventures, which placed tech angled bets on Endless West, Impossible Foods, and Perfect Day; Kleiner Perkins, with its check to Beyond Meat; and Khosla Ventures, with its participation in Perfect Day and Ripple, represented the tech set. The intersection of new technology paired to food brands most excites this group.

Also worth noting is the distribution of deal activity more generally. Of the 412 investors tracked in 2018, 160 wrote no checks at all. While some of that group may have quietly shuttered or some deals went unnoticed, the 202 active firms were still predominantly one check ponies. Of the 430 tracked checks written in 2018, nearly half (45 percent) came from just 30 firms. Another notable development is that A-tier firms appear to be increasing the size of their investment, while decreasing their investment frequency. VMG, for example, made just four disclosed investments in 2018, but the rounds in which they participated averaged $37 million, including Ancient Nutrition ($108,000,000), SmashMallow ($10,000,000), Spindrift ($20,000,000), Humm Kombucha ($10,000,000).

In 2018, an expanded array of corporate VCs began to invest off their balance sheets, following the precedent set by name brand corporate venture incubators and funds such as Coke’s Venture Emerging Brands (“VEB”). Ingredient supplier Döhler Ventures, for example, has taken positions in Bizzy, REBBL, Ripple Foods, Vive Organic, Vrai, and Your Super. WeWork’s Food Labs, which wasn’t officially announced until March 2019, had nonetheless begun meeting with brands and touting its global reach before the new year.

As usual, however, and the above notwithstanding, the only thing more exciting than the trends within the investment community were the trends among the brands themselves.

Food & Beverage Investment Category Data

The following is a breakdown of investments by category, including alcohol, alternative dairy, alternative protein, bars, beverages beyond water, CBD & THC, chips & salty snacks, coffee, tea & kombucha, keto, protein beverage, sweets, soups & broths, supplements, and other.

Please note, for the graphs and data presented below, every company is only classified in one category. Editorial judgement is used when determining how to group these brands.

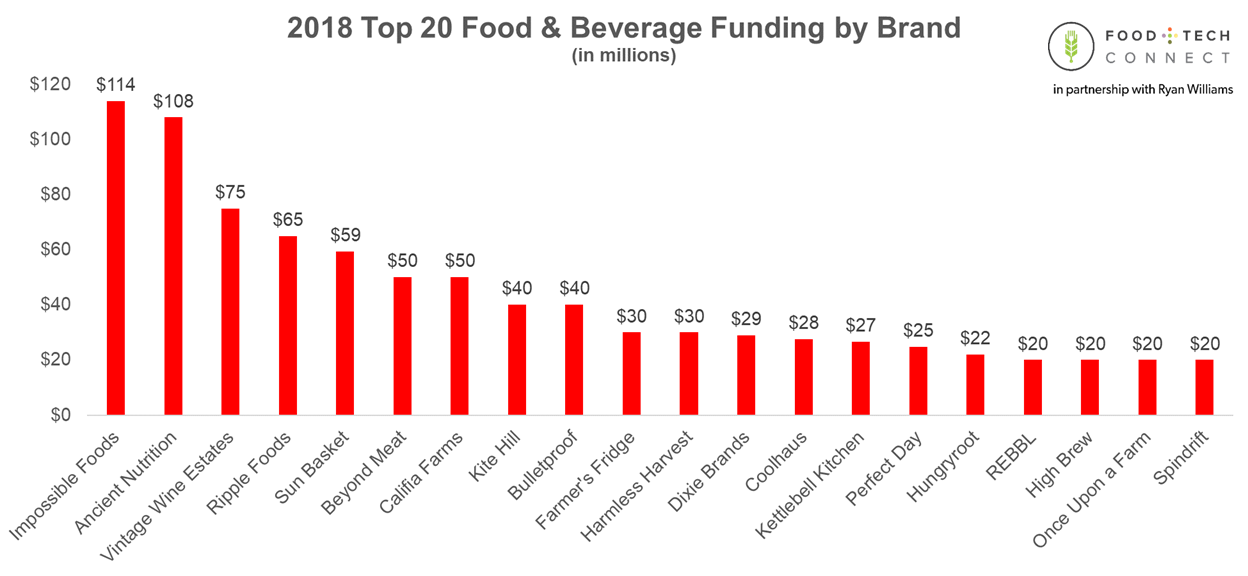

Top 20 Food & Beverage VC Investments by Brand

![]()

Like 2017, there were two brands in the $100 million club. Following Brewdog ($190 million) and JUST ($150 million) in 2017, this year’s nine-figure club included Impossible Foods and Ancient Nutrition. Six of the top 20 brands (Beyond Meat, Bulletproof, High Brew, Impossible Foods, Perfect Day, and Spindrift) appeared years, raising a combined $461 million.

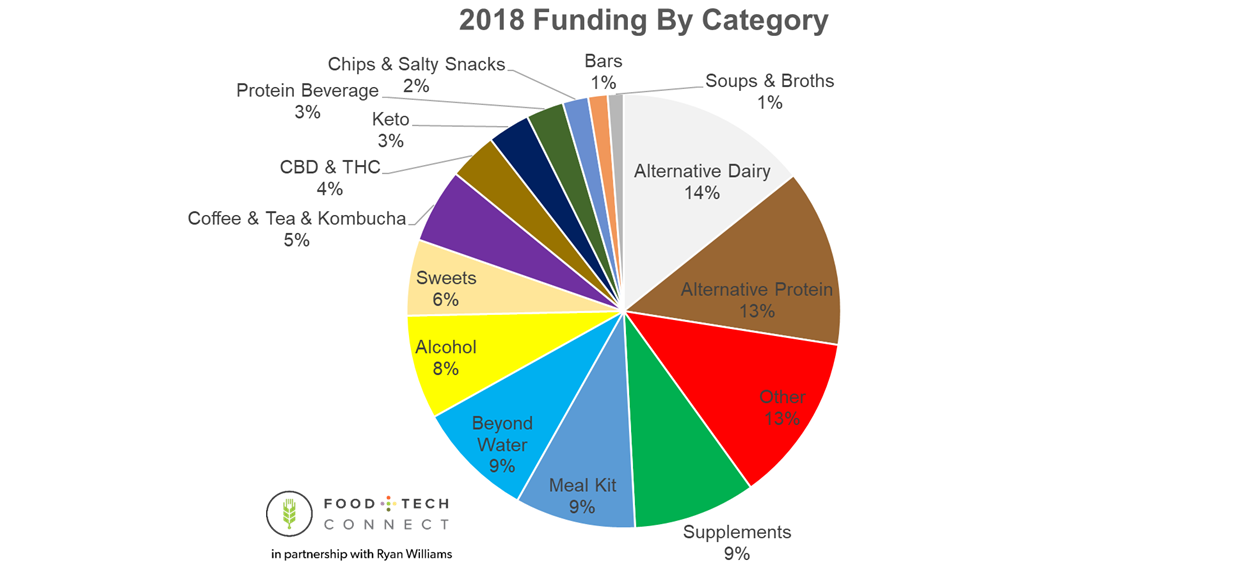

2018 Food & Beverage Funding by Category

![]()

Besides “Other” being the largest category and encapsulating companies ranging from Once Upon a Farm to RollinGreens, the most noteworthy outcome was alternatives to dairy and animal-based protein were both the first and second tracked categories, representing one-third of the overall pie. No wonder plant-centric investment firms have had no trouble expanding their portfolios.

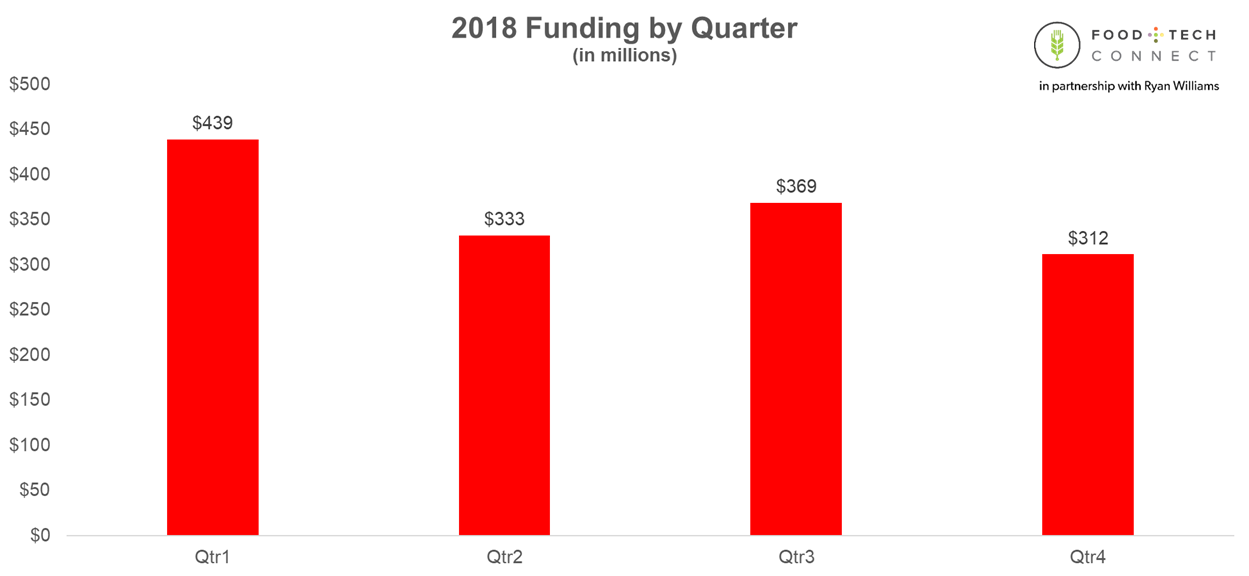

2018 VC Investments By Quarter

![]()

As compared to 2017, the quarter over quarter deal activity volumes were more stable. The two biggest quarters of the year, Q1 and Q3 also included to the two biggest deals of the year – $108 million to Ancient Nutrition in March and $114 million to Impossible Foods in October, respectively.

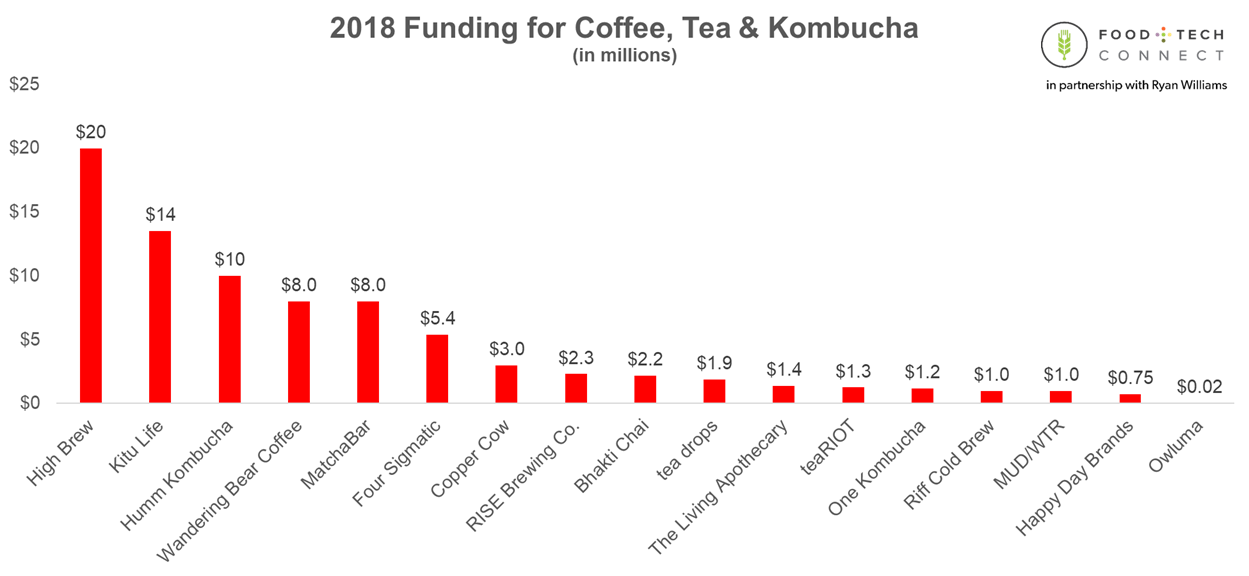

2018 Funding For Coffee, Tea & Kombucha

![]()

High Brew has been highly funded, occupying the top spot in 2018 after raising $17 million just a year earlier. Humm has also been humming along, following its 2017 raise of $10 million with another $10 million in 2018. These two leaders have been backed by what many would call the biggest respective brands on the venture side of the table – CAVU Ventures and VMG.

Note: undisclosed fundings in 2018 included Brew Dr. Kombucha, VitaCup, Wicked Lekker, Sweet A Little, Metabrew, and Vera Roasting Company.

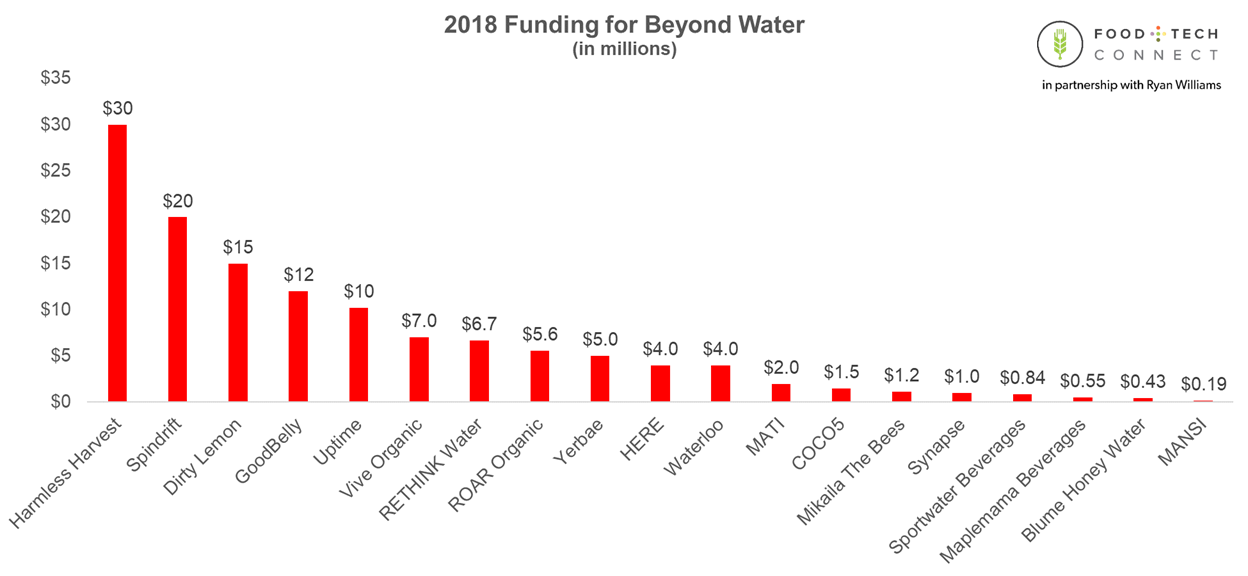

2018 Funding for Beverages Beyond Water

![]()

Investor willingness to back cold-chain beverage has grown. In fact, about half of category dollars went towards cold-chain brands, led by Harmless Harvest and Dirty Lemon. What remains to be seen, however, is large CPG willingness to acquire and support such companies. For example, Coke’s relationship with Suja has proven challenging and even at $100 million in sales, Coke backed kombucha breakout Health-Ade remains unprofitable. The costs and supply chain complexities of cold-chain distribution need to be addressed before these brands can successfully integrate with publicly traded CPG portfolios.

Note: undisclosed fundings in 2018 included GIVN Water, Poppilu, and Vitox Drinking Vinegar.

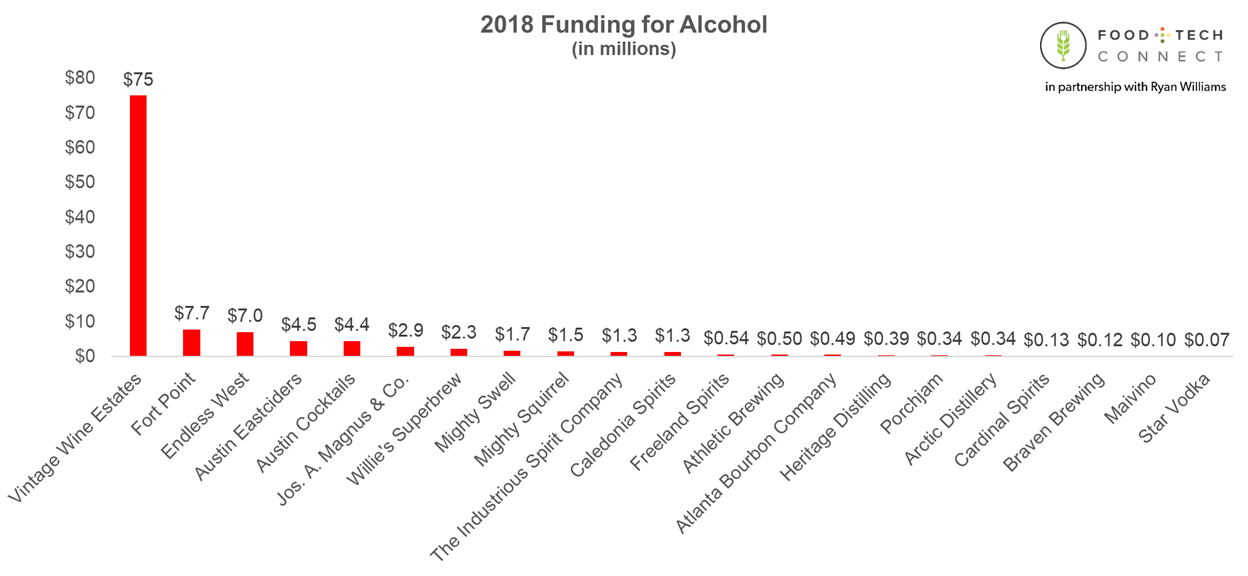

2018 Funding for Alcohol

![]()

Wine, beer, whiskey, and canned cocktails – alcohol investments of 2018 run the gamut of the booze spectrum. Alcohol is often considered a staid category, but in recent years, more attempts are being made to introduce truly differentiated products. Endless West, for example, employs a proprietary process to accelerate the aging of its spirits. Willie’s Superbrew offers unique flavor combinations and advocates for nutrition label transparency beyond the lax requirements afforded to alcohol producers. And finally, KeVita founder Bill Moses’s newest venture, Flying Embers, embraces the natural alcohol of kombucha for a refreshing, bubbly yet boozy, creation.

Note: undisclosed fundings in 2018 included Bodega Luigi Bosca, Laws Whiskey House, Flying Embers, Vivify Beverages, Swish Beverages and Brooklyn Gin.

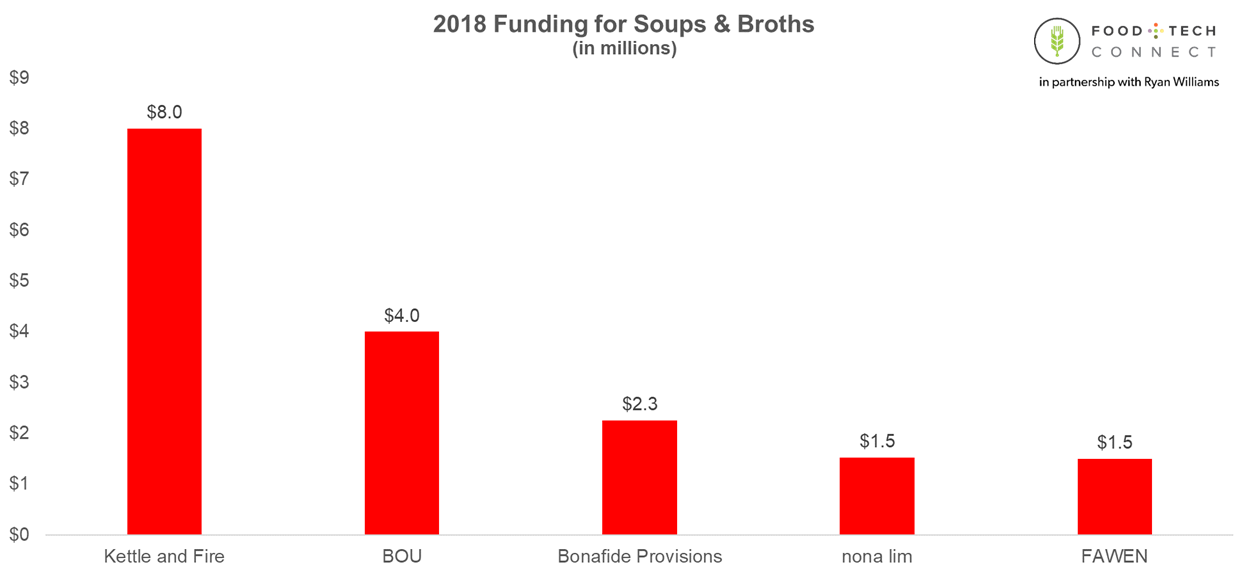

2018 Funding for Soups & Broths

![]()

Sometimes, it’s what seems less exciting that has the most potential. Case in point – B.O.U, a modern, better-for-you bouillon maker that, while competing in a lower velocity, smaller, and admittedly unbuzzworthy category, also faces significantly less competition and impediments to gaining shelf space.

Note: undisclosed fundings in 2018 included Splendid Spoon.

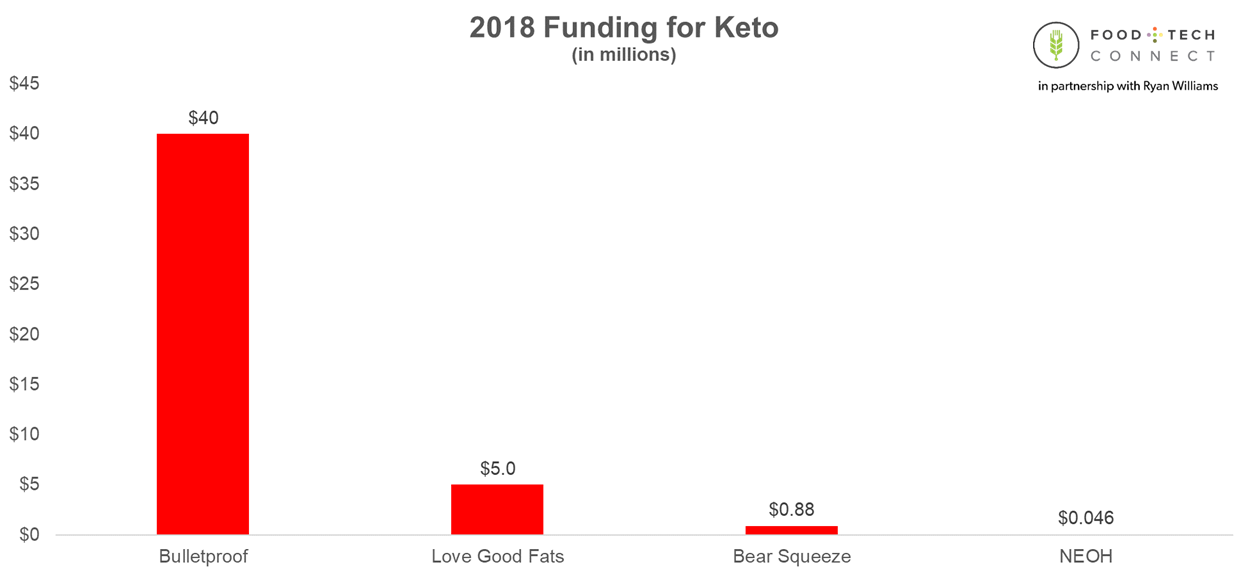

Funding for Keto

![]()

For diet-trend led brands, their identify is dual-defined. Is Bulletproof a keto brand that makes coffee or a coffee brand that makes keto? Nonetheless, keto deserves a mention in 2018 as it has become just as popular as gluten-free was not so long ago. Many companies, including Cave Shake, Bear Squeeze, and Quevos, wisely embrace keto while remaining cautious in fully ensconcing their identities in the trend.

Note: undisclosed fundings in 2018 included Cave Shake and Disruptive Enterprises.

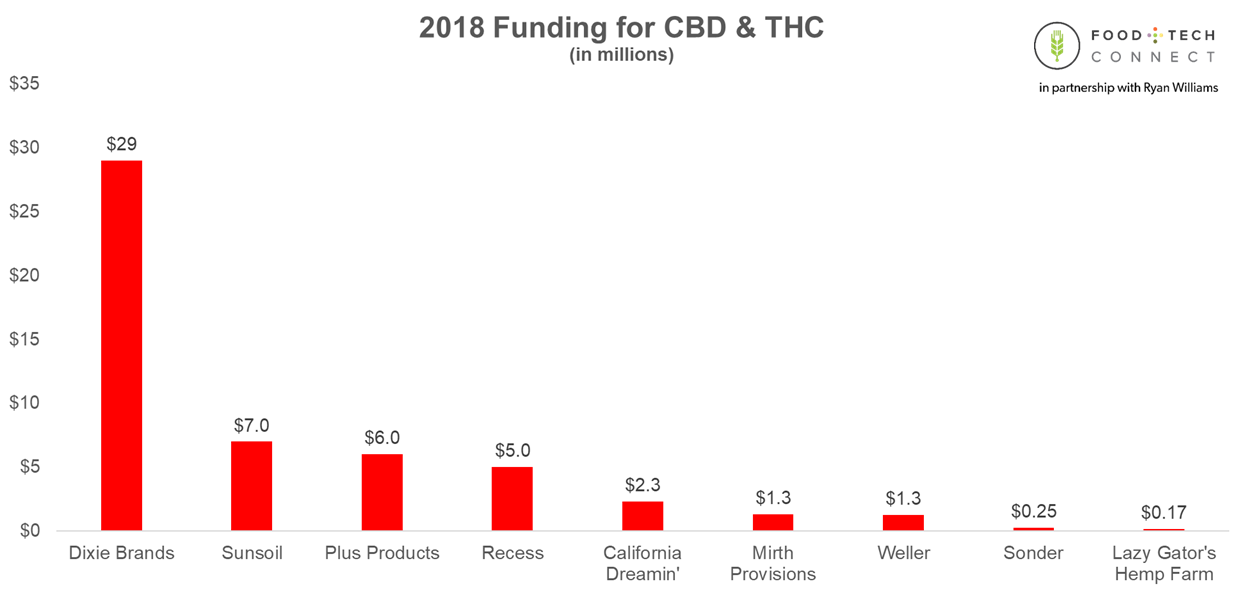

2018 Funding for CBD & THC Food & Beverage Brands

![]()

Funding for CBD and THC has started to light up. Once a taboo and restricted by tight regulations, increased acceptance at the state and, perhaps soon, federal levels has opened a path for national, big-time brands. Coke CEO James Quincy continues to be skeptical, recently commenting, “The way I think about ingredients is the following: Is it legal? Is it safe? And is it consumable?…It’s not legal in the U.S…Is it safe? Science is out…We want to sell drinks that people can drink each day.” On the opposite end of the spectrum, Constellation Brands placed a $4 billion bet on Canopy Growth in October 2018, describing its view as, “extremely bullish, if not more bullish” on an earnings call. Risk-tolerant investors agree, with RTDs such as Recess and California Dreamin’ receiving millions in investment despite nascent sales data. Even if their investments go south, at least those VCs will be able to relax.

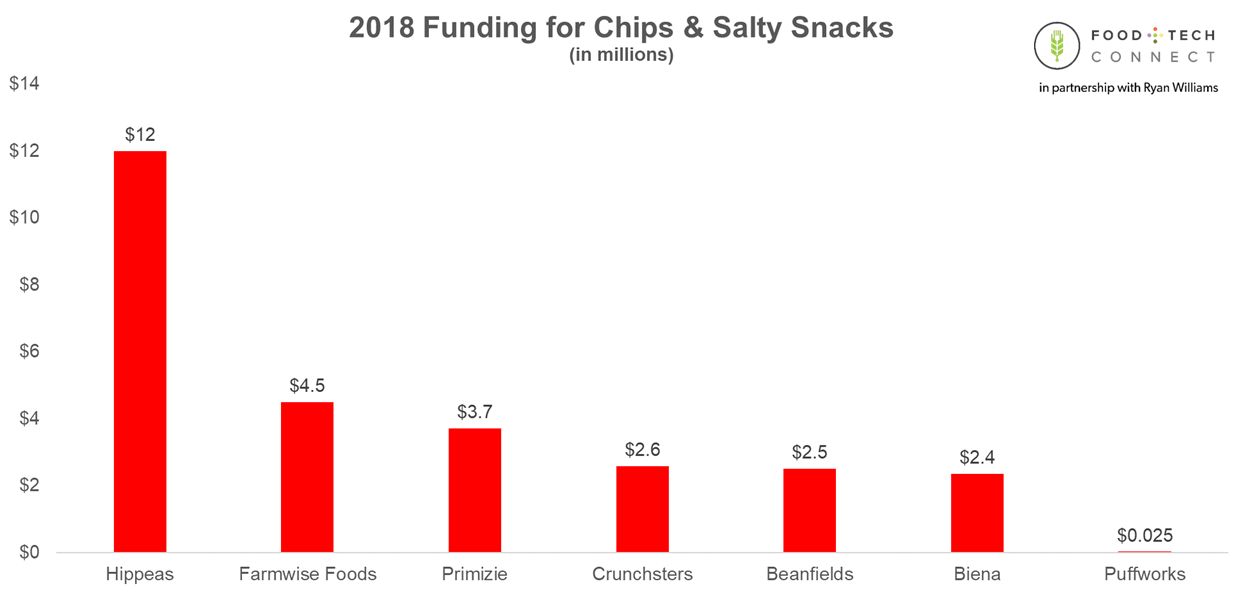

2018 Funding for Chips & Salty Snacks

![]()

Every notable crunchy or salty snack investment of the past year went towards a non-potato based brand. Leading the group was CAVU Ventures backed Hippeas, which has raised $22 million to date on its reported path to both profitability and $100 million in sales. Following a stint of Powerplant Ventures and Zico founder Mark Rompolla briefly assuming the CEO role, Beanfields has also matured nicely.

Note: undisclosed fundings in 2018 included Quevos.

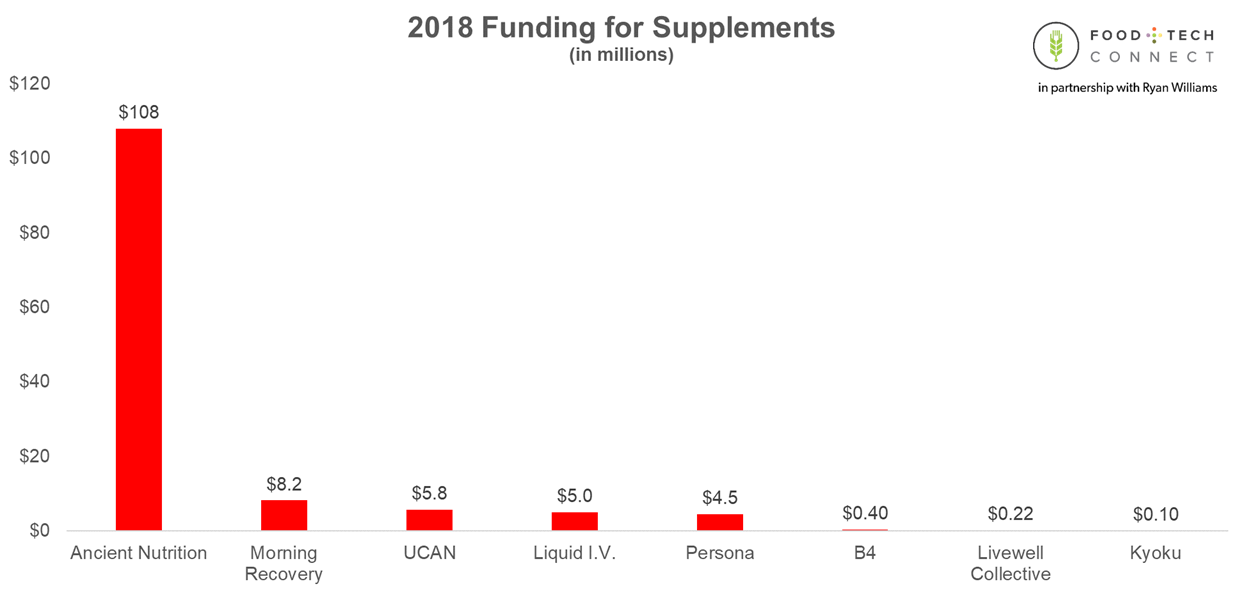

2018 Funding For Supplements

![]()

Supplements and direct-to-consumer make a great match. Low weights, high margins and the ability to target specific demographics helps explain why e-commerce has been a focus of most venture backed brands in the category. The $108 million round for Ancient Nutrition generated quite a stir. In addition to VMG and ICONIQ Capital, Ancient Nutrition attracted a veritable “who’s who” roster of angel investors. Supplements are also one of the few categorizes in which “personalization” is actually happening. Joining the likes of Care/of and Ritual, Persona, which makes customized vitamin regimens, closed a $4.5 million round from Emil Capital Partners, L Catterton, and Mindset Venture Group.

Note: undisclosed fundings in 2018 included Uplift Food, Hangnever, Cure Hydration, and Enduraphin.

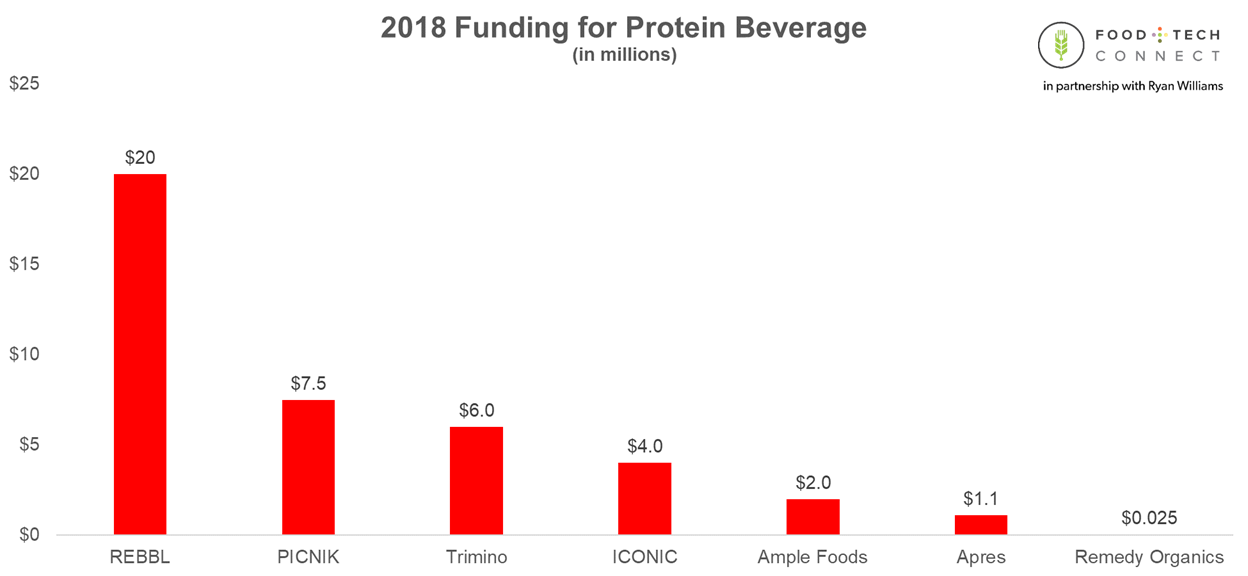

2018 Funding for Protein Beverages

![]()

It feels like not too long ago, the only protein beverage option was Muscle Milk. Over the past few years, a number of better-for-you protein brands have emerged, with unique twists to differentiate themselves from a broadening set. From REBBL’s use of adaptogens to Ample Foods’s “just add water” format, the protein enhanced beverage category reflects the rapid innovation that is occurring throughout the industry as a whole.

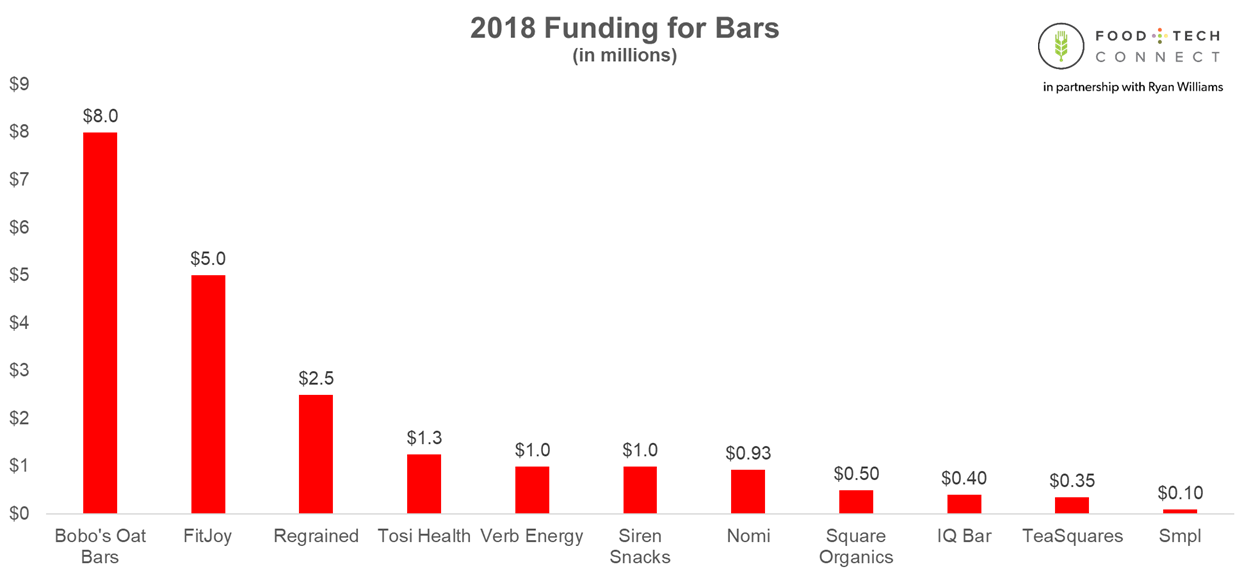

2018 Funding for Bars

![]()

Investors continue to support innovation in the bar category in terms of deal frequency, with 11 brands attracting institutional dollars in 2018. The average check size, however, was just $1.9 million, significantly less than the $7.3 million average across the industry. Especially with the exits of companies like RXBAR to Kellogg and Health Warrior to Pepsi, startups are going to face an increasingly difficult time getting on shelf, getting off shelf, and ultimately, getting acquired.

Note: undisclosed fundings in 2018 included Cherryvale Farms and Milkful.

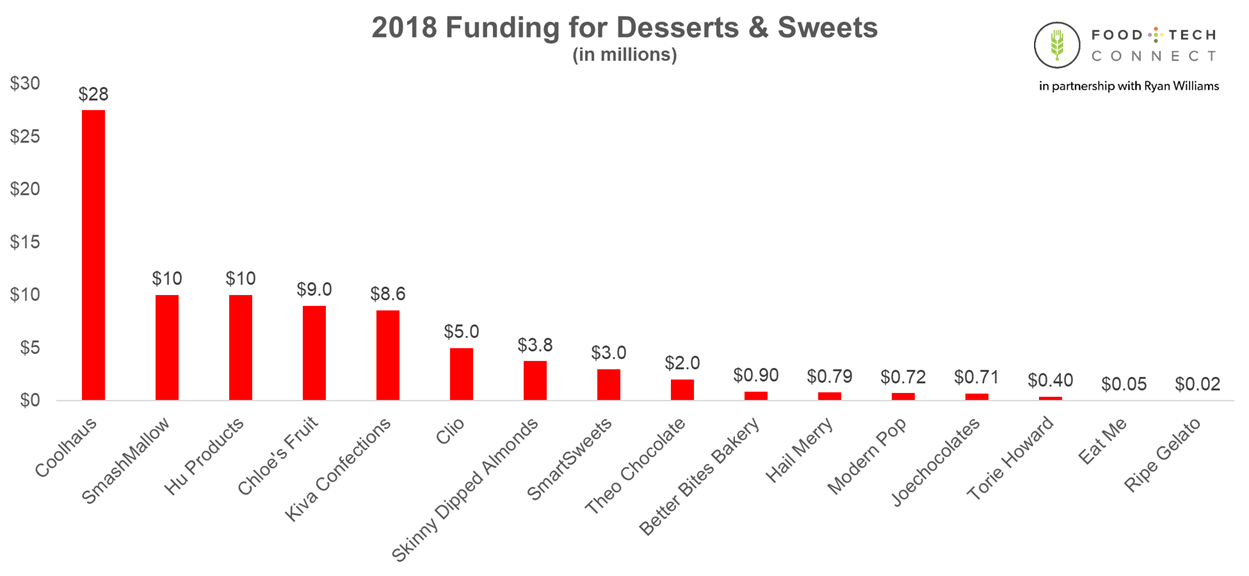

2018 Funding for Desserts & Sweets

![]()

The best and brightest sweets companies prove it’s possible to survive the sugar inquisition. Whether through innovation like SmashMallow’s snackable marshmallows or moderation, as demonstrated by Chloe’s all-natural fruit pops, creating something unique, tasty, and responsibly indulgent continues to open investor wallets and consumer mouths.

Note: undisclosed fundings in 2018 included Buff Bake, Fancy Sprinkles, Good Day Chocolate, JJ’s Sweets, Little Secrets, and Van Leeuwen.

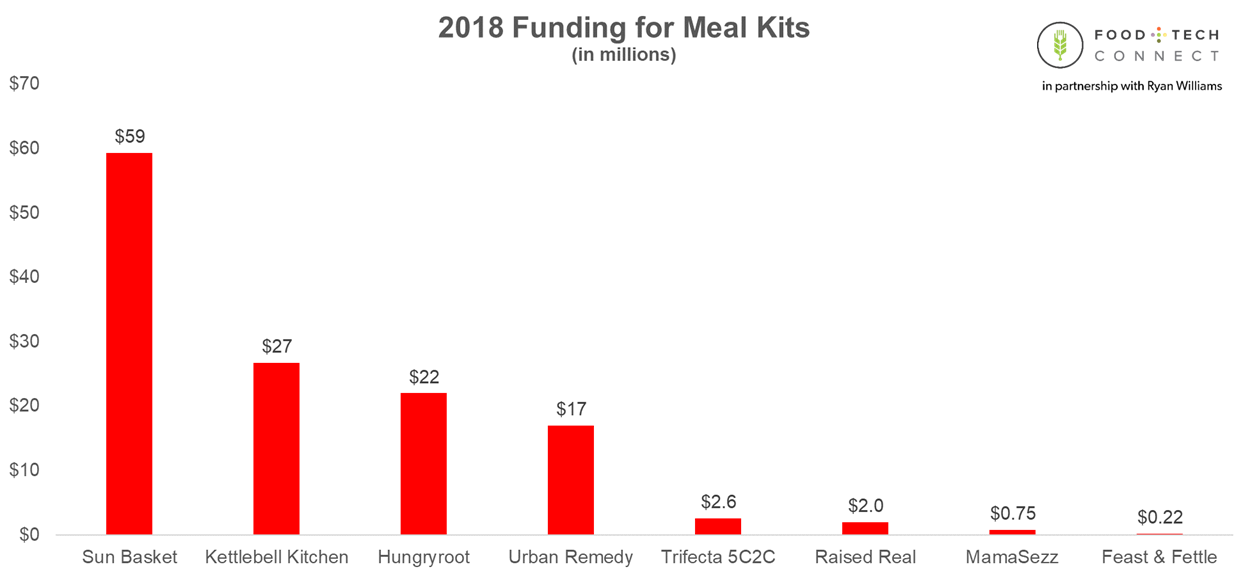

2018 Funding for Meal Kits

![]()

Amidst the struggles of category creator Blue Apron, many would expect investors to have written off the meal-kit category. Even though category funding is down significantly, focused offerings targeting specific dietary needs or recipe formats have received continued support, with Sun Basket’s organic options leading the charge.

Note: undisclosed fundings in 2018 included Ono Food Co.

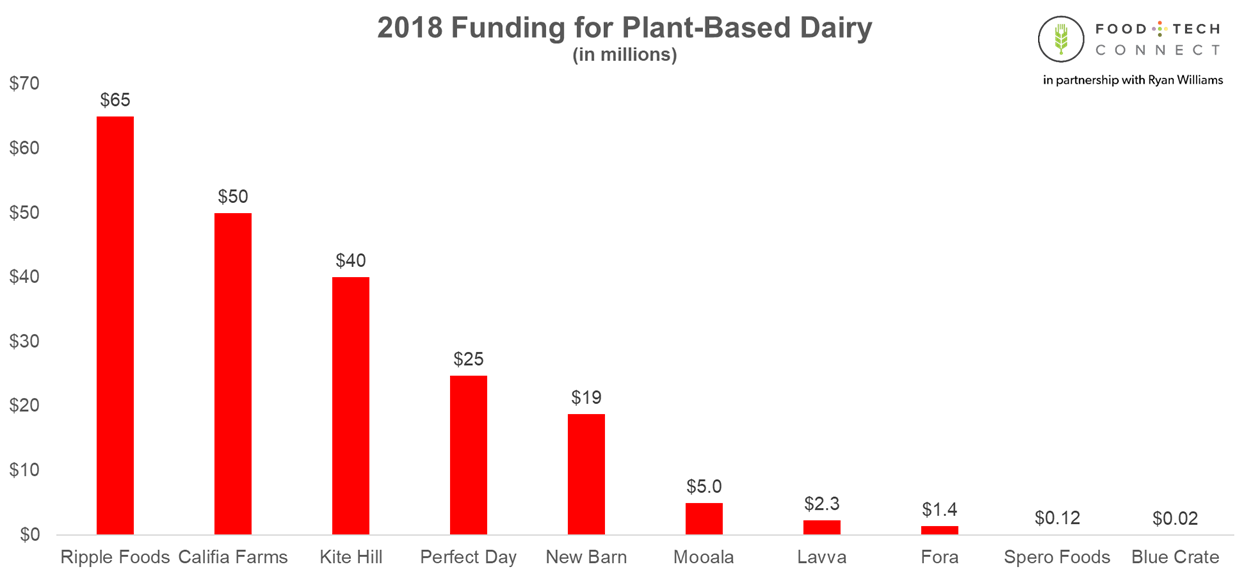

2018 Funding for Plant-Based Dairy

![]()

Dairy alternatives was the top category of the year, raking in over $200 million in total investment, with three companies (Ripple Foods, Califia Farms, and Kite Hill) raising $40 million or more. In addition to the direct leaders, products from brands in other categories have also embraced the trend, with offerings ranging from oat milk cold brew coffee to almond milk based ice cream.

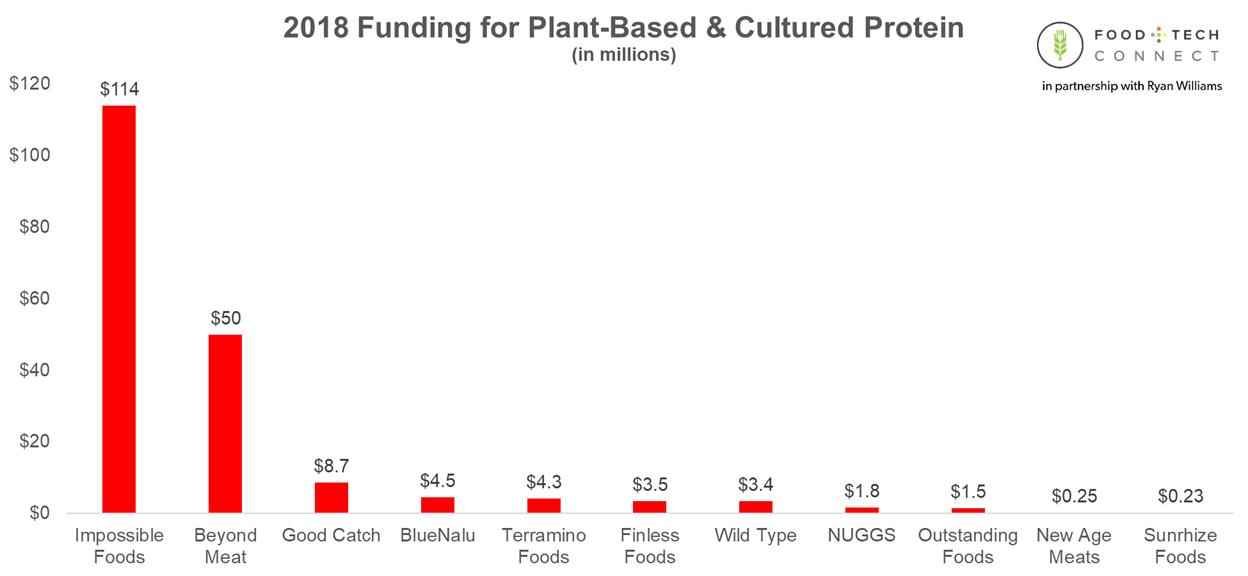

2018 Funding for Plant-Based & Cultured Protein

![]()

![]()

Second only to alternative dairy was alternative meat and seafood, which collected a combined $192 million.

Note: undisclosed fundings in 2018 included Alpha Foods.

If you enjoy this free report, please subscribe to our newsletter

and tag us #foodtech @ryanstuartwill @foodtechconnect

Notable 2018 CPG Trends

Notable 2018 CPG Trends

CPG Retail Innovation

Following the playbook of brands like Warby Parker and Away, digitally native food and beverage brands began looking for ways to connect with their customers in person. Recognizing the value of in-person experiences to increase retention and lifetime value of their existing customers, while also presenting an increasingly cost effective customer acquisition channel amidst the rising prices of online ads, some of the most innovative brands launched Instagramable brick-and-mortar stores to engage with their customers offline.

Dirty Lemon, for example, launched The Drug Store, an instagram-perfect concept store in Tribeca, this past September to much fanfare. The goal of the store was to use a unique retail experience as a way to stand out in a sea of competitors with equally compelling digital marketing. Dirty Lemon is reallocating nearly all of its $4 million annual digital advertising budget to opening more Drug Stores, CEO Zak Normandin told The New York Times. More than a mere new channel for sales, the store forces customers to check out using its text-based payment flow. This brings in both sales and facilitates a digital connection. The buyer can then be marketed to via text, email and other means.

Hint, one of the leaders in D2C beverage, opened a 1,500-square foot experiential water bar in San Francisco’s Cow Hollow district where customers can sample and purchase its products. The purpose of the store is to turn Hint into an omni-channel lifestyle brand, CEO Kara Goldin told BevNET. Not to be outdone, Daily Harvest, a healthy meal delivery startup, launched a four day pop-up in New York City, which it has taken on the road to more cities in 2019. Rachel Dori, the company’s CEO, described her desire to, “to learn from and interact with consumers offline,” as its primary objective.

Far from the neon lights, crowded aisles, and disenchanted staff of traditional brick-and-mortar, these brands and more are successfully rethinking retail. By applying the same attention to detail and relentless customer focus reflected in their online experiences to their first forays in the physical world, an increasing number of food and beverage startups are successfully reimagining retail for the coming decades.

Meal Kits Fade

Meal kits illustrate how yesterday’s trend can quickly become today’s has-been. Once lauded as a disruptive alternative to traditional grocery purchase and prep, they have fallen out of vogue. Category creator Blue Apron’s stock price has hovered beneath $1.00 – down nearly 90 percent since its June 2017 IPO debut. Chef’d, which had raised $35 million from Campbell’s and Smithfield Foods, abruptly shuttered in July 2018. Munchery, Maple, Just Add Cooking and others have also seen their demise.

And yet, there remains hope. HelloFresh recently overtook Blue Apron as the top meal kit company in America, with revenues surpassing $1.3 billion. Sun Basket, an organic focused provider, had enough traction to close a $57.8 million round to begin the year. In their favor, meal kits offer convenience, entertainment, and personalization. Navigating fierce competition, challenging logistics and unit economics, and the retention of fickle customers over long periods will be key qualities for the winners of this space.

Sugar Reduction and Alternatives On The Rise

First they came for fat, then they came for gluten, and for the past few years, they’ve come relentlessly for sugar. While fat and gluten seem to have survived – in fact, (good) fat has recently become in vogue for followers of the keto diet – the assault on sugar sees no sign of abating. According to data published by the USDA, per capita sugar consumption has been down for four consecutive years and is now at a 30 year low.

This trend has given life to new startups, including Spindrift, Koia, Quest Nutrition and Halo Top. It has also spurred growth at legacy companies like La Croix and even forced innovation at the largest CPGs such as Pepsi, which launched its own sparkling water brand, bubly, in February 2018. The avoidance of sugar – and increasingly consumer distaste for sugar alternatives such as stevia and monk fruit – has and will continue to foster innovation in nearly all categories of food and beverage.

Big Meat Invests in Cultured Meat

In the face of shifting consumer preferences, industry incumbents have been surprisingly supportive of startups developing cultured meat and seafood products. Tyson Ventures backed Memphis Meats and Future Meat Technologies. JUST (formerly Hampton Creek), which has raised about $220 million, began exploring cultured meats, with controversial CEO Josh Tetrick targeting a launch of lab-grown chicken by the end of 2018. Although that deadline has passed, the company nonetheless has expanded its offerings from mayo to cookies, egg-whites and other animal free products. While this report only covers the U.S. landscape, it is notable that Israel-based SuperMeat closed a $3 million seed round in early 2018 with participation from PHW, one of Europe’s largest poultry producers, while leading Swiss meat manufacturer Bell Food Group participated in Mosa Meat’s $8.8 million round.

In addition to the scientific and manufacturing challenges of making lab-grown meat taste just like the real thing, however, startups will all face regulatory issues and a cultural hurdle in convincing people to switch away from traditional meat.

Plant-Based Growth

Plant based has hit prime time. The plant-based foods industry saw a 20 percent growth in dollar sales since 2017, according to the Plant Based Foods Association (“PBFA”). In the U.S. alone, sales of plant-based meats grew over 23 percent, exceeding $760 million in 2018. Nielsen, a leading retail data company, reported plant-based food sales topped $3.3 billion over the past year.” The global plant-based protein market is projected to reach $5 billion by 2020.

The economic, environmental and health benefits associated with a plant-centric diet has enabled startups to gain traction in everything from plant-based yogurt (eg. Kite Hill) to seafood (Ocean Hugger Foods) to dairy (Perfect Day) to mention plant-based meat. Beyond Meat and Impossible Foods are the vying contenders in what has the makings of a new duopoly and continue to trade punches. Beyond Meat has already secured partnerships with chains such as Carl’s Jr. and TGI Fridays while Impossible Foods has responded by inking deals with White Castle, and recently, Burger King. This trend truly deserves its own report and the recently published research brief from CB Insights, “Our Meatless Future: How The $90B Global Meat Market Gets Disrupted” is a great primer for anyone wishing to dig deeper on this important trend.

CBD & Cannabis

The CBD space has been anything but chill. California Dreamin’, Plus Products, Recess, Sunsoil and Weller, in addition to others under the radar, all received institutional backing in 2018. From the hemp supply side (Plus Products, Sunsoil) to RTD (California Dreamin’, Recess), the industry has begun to evolve, despite the legal grey area in which the industry operates. That said, anyone reading and looking for inspiration would be well advised to examine this list as there still remain product categories ripe for development. Cannabis pizza? THC Twinkies? Why not kill two birds with one stone?

As reported by Time, “CBD that is extracted from hemp (which must have an extremely low level of THC) has only been legal nationwide since the Agriculture Improvement Act — better known as the Farm Act — was passed in December 2018. CBD that is extracted from other cannabis plants is still illegal on the federal level, but may be legal under state law.”

Given that the product doesn’t get users “high” and the progressiveness individual states including California, Colorado and Oregon have shown towards more potent cannabis, the full scale legalization of CBD appears within sight. Both Walgreens and CVS have begun selling CBD in their stores, paving the path for other retailers and other major players such as banks to accept producers without opposition.

![]()

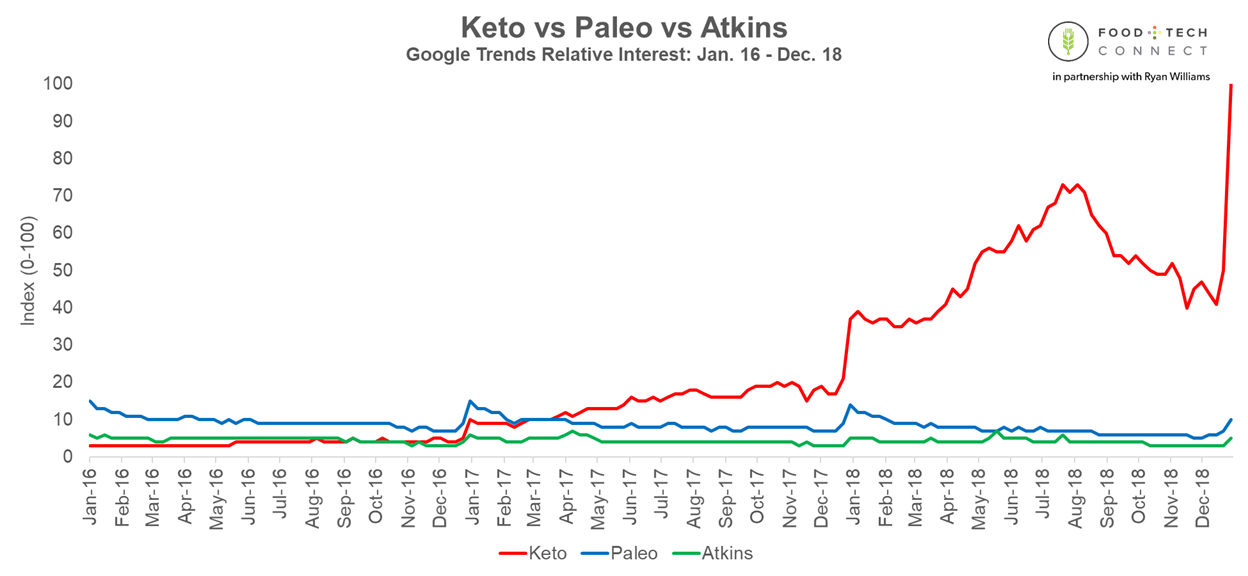

Keto

It wasn’t too long ago that fat was the target and not the trend. In the late 1980s, former U.S. surgeon general C. Everett Koop went so far as to place fat on par with smoking, noting: “The depth of the science base underlying its findings is even more impressive than that for tobacco and health in 1964.” New research and understandings about the role fat plays in health has caused many to question the fat-wa, instead embracing it as part of a healthy, low carb diet.

No shortage of brands have been ready to seize on this explosive growth. But is fat – and by extension, keto – a fad? There’s keto cookies from Fat Snax, keto chocolate from ChocZero and keto cheese crisps from Whisps. On top of all of that, there’s the elephant in the room, Bulletproof, which has become a broader platform ranging from butter coffee to supplements. Diet preferences, however, come and go, which makes them risky investments. As Sophie Bakalar puts it, “invest in food trends, not diet fads.” Whether a new diet will earn a place on the chart below or keto will continue to grow, we’ll just have to wait for the 2020 report to see and know.

Digitally Native

More and more brands are choosing D2C models because it allows them to circumvent the costly and limiting realities of traditional retail, while also forging direct relationships with their customers. Even when they do enter the physical realm, it’s often been with their own stores, as Dirty Lemon, Daily Harvest and others have shown. Now, conglomerates are also putting dollars into comprehensive online strategies.

The party won’t last forever. CPC rates are increasing, low barriers to entry encourage even more competition and the biggest player, Amazon – which took over 50 percent of online sales in 2018 – now controls Whole Foods, the retail partner with the greatest cachet. Aside from the short list of true breakout brands built online, most will be forced to create and execute an omnichannel strategy. It may be in with the new, but it’s not going to be out with the old anytime soon.

Still, Brick Meets Click forecasts that online grocery sales will increase 10 times more than in-store sales over the next five years, as well as comprise 8 percent of total grocery sales by 2022.

Looking Forward

Food startups are trendy. It only takes a stroll down the aisles of Natural Products Expo West or a chat with recent college grads to realize this. Brands take center stage on Shark Tank and garner the attention of celebrity investors ranging from Kobe (Bodyarmor) to Drake (MatchaBar). There are nearly 400 active CPG focused venture capital and private equity firms, operating everywhere from West Palm Beach to Westport.

The existing food system remains ripe for revolution and the economic opportunity of modernizing everything from sugary soda to fatty frozen feasts persists. Of the $130.9 billion total venture capital invested in 2018, less than 1 percent went to food and beverage despite the industry accounting for approximately 1.4 percent of GDP and comprising about 2.6 percent of S&P 500 market capitalization (data as of April 2019).

And yet, there are whispers of a potential slowdown. The market can only support so many better for you XYZs and direct to consumer CPGs. The headwinds to early stage food and beverage investing are multifold.

For startups, the barriers to entry have never been lower. Shopify, Amazon, and smaller-scale co-packers have allowed new companies to launch with limited capital investment. Relatedly, brands can attract niche followings through targeted online advertising and by gaining initial retail consumers by emphasizing their “local“ provenance.

The smattering of brands that differentiate based on geography, branding, and niche taste and diet preferences simultaneously erodres the market share of incumbents while hindering any single startup’s ability to become a high-priced acquisition target. As one example that may play repeat, the long tail of lingering, independent craft breweries cannot yield VC type returns. Sure, a few will reach escape velocity – Lagunitas in beer or Sir Kensington’s in condiments or Tate’s in cookies – but it’s increasingly difficult to separate from the pack. The “size of the prize” changes very quickly once shared.

For investors, deals have never been more competitive. Valuations average between 3x and 6x sales, although the hottest brands command 10x. LP dollars are also waiting to be deployed in old guard and newly launched funds alike. Returns will be squeezed by the competitive forces impacting both term sheets and retail shelves.

Acquirers also appear less willing to make mega acquisitions, instead trending towards earlier stage investments and buyouts. “The large Consumer Packaged Goods (CPG) companies, which are consistently losing market share to their early stage competitors, continue to actively acquire rapidly growing early stage food and beverage companies that can serve as new avenues of growth,” notes Nebari Ventures Managing Partner Alex Malamatinas. Nearly every publicly traded CPG has an incubator or venture capital group. These VC divisions provide early support and a clearer path to exit but often with a call option caveat that allows them to acquire allied brands at a discount to their fair-market value. From an investment perspective, it may be that consistent singles and doubles outperform a spate of strikeouts offset by a periodic grand slam.

The big CPGs also find value beyond the bottom line of their targets. Some recent acquisitions seem to be driven more for their educational potential than their immediate earnings impact. For example, Unilever bought Dollar Shave Club for $1 billion when its sales were under $200 million and Walmart acquired Jet.com for $3.3 billion and over 6x its trailing 12 month sales. E-commerce, cultured protein, and better-for-you brands generally remain knowledge gaps for most of the large CPGs.

The above notwithstanding, the notable startup acquisitions of 2018 – Core Nutrition, Tate’s Cookies, Bare Snacks, and Primal Kitchen – went for about $1.4 billion combined. Set against the $1.2 billion in disclosed early-stage investment, the troubling economics become clear. The allure of exits such as Bai ($1.7 billion) may endure, but they are unicorn deals. Although CPG VCs are not as home run dependent as their tech counterparts – meaning they don’t rely on a single exit or two to return their funds – the recent paucity of even nine-figure exists and absence of 10 figure deals should be worrying.

The high price tags commanded by the brightest startups encourages conglomerates to develop brands internally. For example, in January 2018, Unilever was close to buying better-for-you ice cream maker Halo Top for roughly $2 billion. It balked and ultimately launched a competing brand, Culture Republick. While the misspelled name is as want-to-be-hip cringeworthy as Pepsi’s bubly, it also prevents Halo Top’s backers from realizing a return. La Colombe similarly floated a $1 billion dollar price tag, which seems to have fallen on deaf ears. On top of this, many retailers have launched successful private label offerings.

The margin impact of innovation also poses challenges. Apart from platforms like Bulletproof that can leverage their brand awareness to expand into higher margin categories such as supplements, many startups seemingly lack a pathway to sustainable gross margins which buyers can transform into positive EBITDA. There is an old refrain that “40 is 20” meaning 40 percent gross margins in startup phase enable 20 percent EBITDA margins at scale; there is a reality that many startups, fueled by VC dollars, are operating well below that threshold.

Startups and investors can respond to emerging challenges in a few ways.

Startups would be wise to focus on true differentiation, especially by developing seemingly onerous core competencies. Notable examples include Daily Harvest’s frozen shipping logistics and Dirty Lemon’s text-based ordering. Bang Energy, which has built an in-your-face, far-from-Whole Foods brand also deserves credit for its contrarian path. The ability to become a platform, as Primal Kitchen did for condiments or Core Nutrition has accomplished in beverage, should also remain front of mind. Care/of, Bulletproof and Hippeas deserve praise for creating “lifestyle brands” as opposed to defining themselves by the products themselves.

Contrarily, an abstention from the high-flying, growth-at-all costs mentality can setup longer-term potential. There are profitable, digitally native, under-the-radar brands hawking everything from matcha to keto cookies to overnight oats pulling in nearly seven figures a month. Cash flow allows them to chart their own destiny unencumbered by the pressure of investor expectations.

Investors ought to prize differentiation, platform potential and scientific innovation. The first can be as simple as owning a unique twist on a category, such as nitro as opposed to regular cold brew. The second, as mentioned above, appears when the brand’s values positively outshine its products’ ingredients. The third is most prominent in the growing cellular based meats and seafood category. Between Beyond Meat’s upcoming IPO and the buzz around Impossible Foods, the intersection of biotech and food appears to have the greatest upside potential.

If there is a downturn, conglomerates stand to benefit. They know they need to modernize their brand portfolios and may be able to acquire solid concepts at low prices. This period may also give rise to the birth of Hain Celestial 2.0 holding companies, which understand both the operations component and how to market to millennial consumers. Dunn River Brands, Sonoma Brands, New Age Beverage and others are leading the charge here. There have even been rumors VMG is in the process of raising a distressed fund to acquire flailing brands on the cheap.

Of course, none of this should overshadow all the reasons food and beverage startups have taken off. As Jordan Gaspar, Managing Partner of New York City based venture fund AccelFoods recently noted, “It’s an exciting and unprecedented time to be investing in the food and beverage space. There is a convergence of highly skilled entrepreneurs entering the space, retailer willingness to make shelf space, and innovative products coming to market that is fueling the disruption we see today. This disruption is compounded by strong consumer demand and interest in smaller challenger brands that meet the better-for-you eating and drinking habits that consumers are adopting.”

Indeed, the United States packaged food and beverage industry alone was most recently estimated at $806.3 billion. Considering that nearly every area remains ripe for innovation, roughly $1 billion in annual investment begins to feel more reasonable. Investors will, however, need to see how the cookies crumble before knowing if they’re buying lemons or the cream of the crop.

If you enjoy this free report, please subscribe to our newsletter

and tag us #foodtech @ryanstuartwill @foodtechconnect

Notable Exits

Patron

- Products: Tequila

- Acquirer: Bacardi

- Date: January 22, 2018

- Price: $5,100,000,000

- Why it matters: The acquisition of Patron solidifies Bacardi’s position as a preeminent player across the entire spirits category. In addition to Patron, Bacardi owns Grey Goose vodka, Bombay Sapphire gin and Dewar’s scotch, among others. As overall domestic alcoholic consumption slows, one possibility is consumers will shift their preferences to more premium options – a possibility Bacardi is now even better primed to capitalize on.

Dr Pepper Snapple

- Products: Tea and other beverages

- Acquirer: Keurig Green Mountain

- Date: January 29, 2018

- Price: $25,251,480,000

- Why it matters: Because JAB Holdings, the holding company behind Keurig controlled by the reclusive Reimann family, has established itself as a true threat to the duopoly of Coke and Pepsi. In particular, the acquisition of DPSG expands the coffee concentrated empire of JAB (Keurig, Peet’s, Caribou,Stumptown, Panera and more) to adjacent markets in tea, soda and bottled water.

TCHO

- Products: Chocolate

- Acquirer: Ezaki Glico

- Date: February 20, 2018

- Price: Undisclosed

- Why it matters: Founded in 2005, TCHO was one of the pioneers of the bean-to-bar movement and preceded the broader trend which continues today of consumers prizing traceability and ethical wages for all participants in the supply chain. It’s Japan based acquirer, Ezaki Glico, is best known as the maker of Pocky, which makes us wonder if we’ll even see a TCHO + Pocky collab. We can only hope!

Tate’s

- Products: Cookies

- Acquirer: Mondelez

- Date: May 6, 2018

- Price: $500,000,000

- Why it matters: For all the advice and lessons given by successful entrepreneurs, most great brands chart their own, unreplicable path and the same applies to Tate’s. Founded as a single retail store in South Hampton, New York, Tate’s channeled its unique brand and uniquely crispy cookies into a higher margin yet nationally scalable brand. As one friend commented, “there was something very special about Tate’s. Even though it’s a premium brand with a premium price, the brand seems to hold its own whether in a Whole Foods or a gas station.” Evidently, Mondelez agreed and acquired the brand for nearly half-a-billion dollars.

Bare Snacks

- Products: Baked fruit and vegetable snacks

- Acquirer: PepsiCo

- Date: May 25, 2018

- Price: ~$200,000,000

- Why it matters: Pepsi has made good on its promise to focus on better for you snacking options and this acquisition is no exception. The first of departing CEO Indra Nooyi’s three pillars was, “helping to improve health and wellbeing.” This mission has been quite successful, as Pepsi now derives nearly 50 percent of its sales from “Guilt Free Products.” For such a large company with historical concentrations in sugary sodas and high-fat salty snacks like Cheetos, Pepsi deserves credit for adapting to consumer preferences faster than the vast majority of its publicly traded peers.

RUNA

- Products: Guayusa tea

- Acquirer: Vita Coco

- Date: June 20, 2018

- Price: Undisclosed

- Why it matters: Runa has a storied history. Early to recognize the growing demand for better-for-you energy drinks, the company struck a chord with forward thinking east coasters looking for something healthier than high sugar, chemical laden alternatives. On the other hand, it struggled to hit the escape velocity needed for a mega acquisition. Nonetheless, Runa has found a great home at Vita Coco.

SodaStream

- Products: Home carbonation device and syrups

- Acquirer: PepsiCo

- Date: August 20, 2018

- Price: $3,221,700,000

- Why it matters: As with most success stories, SodaStream began by addressing pain points that later became major consumer values. First, its environmentally friendly solution eliminates the need for single use plastic bottles or cans. And second, its expansive array of concentrates and syrups are able to be dosed to each person’s preference. Finally, the deal is a reminder of the challenges faced by the industry’s largest players to find non-cannibalizing growth. One way to protect the health of their existing brands (Pepsi has 22 with $1 billion + in annual sales) is to explore other categories, use occasions, channels of distribution, or in this case, form factors.

Core Nutrition

- Products: Water and flavored water

- Acquirer: Keurig Dr Pepper

- Date: September 27, 2018

- Price: $525,000,000

- Why it matters: With its overlapping product line, it’ll be interesting to see how Core overlaps with KDP’s major acquisition of 2017, Bai. Also worth noting, Core’s estimated 12 month trailing sales were approximately $200 million when the deal was announced, implying a 2.6x revenue multiple. Bai, on the other hand, went for $1.7 billion while doing approximately $230 million in net sales, implying a revenue multiple of about 7.3x – nearly three times that of Core. Bai’s underperformance relative to post-acquisition expectations may have hammered the willingness for acquirers award outsize multiples for some time.

Primal Kitchen

- Products: Sauces, condiments and dressings.

- Acquirer: Kraft

- Date: November 29, 2018

- Price: $200,000,000

- Why it matters: A rebuttal to Unilever’s 2017 acquisition of Sir Kensington’s, Primal Kitchen will help Kraft modernize its condiments business. Whereas Sir Kensington’s differentiated with its whimsical brand, innovative ingredients like aquafaba and clean ingredient lists, Primal Kitchen has been especially adept at identifying and appealing to diet trends ranging from Whole30 to Paleo.

Revive Kombucha

- Products: Kombucha

- Acquirer: Peet’s (Subsidiary of KDP)

- Date: December 20, 2018

- Price: Undisclosed

- Why it matters: Despite the category as a whole being on fire (estimated to reach $5.45 billion by 2025), there have yet to be any headline acquisitions. Category originator GT Dave’s has evolved in a thriving but privately owned business and leading startup Health-Ade, while still private, has received investment from Coca Cola but likewise remains independently operated. That said, the Peet’s acquisition of Revive may be a clever way for JAB Holdings (which owns both Keurig Dr. Pepper and Peet’s, among others) to dip its toes into kombucha before other conglomerates have a chance to make their bets.

If you enjoy this free report, please subscribe to our newsletter

and tag us #foodtech @ryanstuartwill @foodtechconnect

2018 Food & Beverage Investments

Please note the following list of investments covers only U.S based food and beverage companies that received investment in 2018.

To submit an investor to our database click here.

To submit an investment to our database click here.

8 Myles

- Founder: Myles Powell

- Product(s): Mac n’ cheese.

- 2018 Funding Date: March 1, 2018

- 2018 Funding: $20,000

- Total Funding: $20,000

- Disclosed Investors: Union Kitchen

Alpha Foods

- Founders: Cole Orobetz, Loren Wallis

- Product(s): Plant based burritos

- 2018 Funding Date: March 12, 2018

- 2018 Funding: Unknown

- Total Funding: $4,750,000

- Disclosed Investors: GlassWall Syndicate, New Crop Capital, VegInvest, Arbel Growth Partners, Clear Current Capital, AccelFoods

American Ostrich Company

- Founder: Alexander McCoy

- Product(s): Ostrich

- 2018 Funding Date: February 21, 2018

- 2018 Funding: Unknown

- Total Funding: $2,050,000

- Disclosed Investors: Unknown

Ample Foods

- Founder: Connor Young

- Product(s): Bottled natural meal replacements

- 2018 Funding Date: May 8, 2018

- 2018 Funding: $2,000,000

- Total Funding: $4,000,000

- Disclosed Investors: Slow Ventures, LivWell Ventures

Ancient Nutrition

- Founders: Jordan Rubin, Dr. Josh Axe

- Product(s): Bone broth, collagen, and supplements

- 2018 Funding Date: March 8, 2018

- 2018 Funding: $108,000,000

- Total Funding: $108,000,000

- Disclosed Investors: VMG Partners, ICONIQ Capital, FounderMade Fund

- Comments: Over 100 investors poured over $100 million into Ancient Nutrition in March. Only two years old and playing in the still nascent categorizes of bone broth and collagen supplements, the company’s experienced leadership team is now well positioned to capitalize on a fast growing sector.

Apres

- Founders: Darby Jackson, Sonny McCracken

- Product(s): Plant protein beverages

- 2018 Funding Date: April 25, 2018

- 2018 Funding: $1,100,000

- Total Funding: $1,100,000

- Disclosed Investors: Cambridge SPG, Rocana Venture Partners

Arctic Distillery

- Founder: Jon Maxwell

- Product(s): Craft spirits

- 2018 Funding Date: March 9, 2018

- 2018 Funding: $337,000

- Total Funding: $337,000

- Disclosed Investors: Unknown

Athletic Brewing

- Founder: Bill Shufelt

- Product(s): Non-alcoholic craft beer

- 2018 Funding Date: September 21, 2018

- 2018 Funding: $500,000

- Total Funding: $750,000

- Disclosed Investors: Unknown

Atlanta Bourbon Company

- Founder: Caroline Porsiel

- Product(s): Craft spirits.

- 2018 Funding Date: July 1, 2018

- 2018 Funding: $488,500

- Total Funding: $738,500

- Disclosed Investors: Unknown

Austin Cocktails

- Founders: Kelly Gasink, Jill Burns

- Product(s): Alcoholic cider

- 2018 Funding Date: October 9, 2018

- 2018 Funding: $4,387,626

- Total Funding: $4,387,626

- Disclosed Investors: Constellation Ventures

Austin Eastciders

- Founder: Ed Gibson

- Product(s): Alcoholic cider

- 2018 Funding Date: June 27, 2018

- 2018 Funding: $4,499,993

- Total Funding: $19,246,098

- Disclosed Investors: CAVU Ventures, Fort Ventures, Mark VC

Ayoba-Yo

- Founder: Wian van Blommestein

- Product(s): South African jerky

- 2018 Funding Date: May 14, 2018

- 2018 Funding: Unknown

- Total Funding: Unknown

- Disclosed Investors: Springboard

B4

- Founder: John Mansour

- Product(s): Vitamin infused beverage.

- 2018 Funding Date: March 28, 2018

- 2018 Funding: $400,000

- Total Funding: $1,162,500

- Disclosed Investors: Unknown

Back to the Roots

- Founders: Alejandro Velez, Nikhil Arora

- Product(s): Sustainable grow-at-home mushroom kits

- 2018 Funding Date: May 17, 2018

- 2018 Funding: $2,600,000

- Total Funding: $17,600,000

- Disclosed Investors: M13 Company, S2G Ventures, SWTLF Ventures, Echo Capital Group, Blue Scorpion Investments

Beanfields

- Founder: Liza Braude-Glidden

- Product(s): Bean based chips and salty snacks

- 2018 Funding Date: June 29, 2018

- 2018 Funding: $2,500,000

- Total Funding: $7,000,000

- Disclosed Investors: Ridgeline Ventures, Powerplant Ventures, New Richmond Ventures (NRV)

Bear Squeeze

- Founder: Max Baumann

- Product(s): Keto meal shake

- 2018 Funding Date: February 23, 2018

- 2018 Funding: $879,000

- Total Funding: $879,000

- Disclosed Investors: AccelFoods, Indigogo

Belsazar

- Founder: Maximillian Wagner

- Product(s): Vermouth

- 2018 Funding Date: March 15, 2018

- 2018 Funding: Unknown

- Total Funding: Unknown

- Disclosed Investors: Distill Ventures

Better Bites Bakery

- Founder: Leah Lopez

- Product(s): Allergan free baked goods and sweets

- 2018 Funding Date: August 23, 2018

- 2018 Funding: $900,000

- Total Funding: $1,250,000

- Disclosed Investors: Unknown

Beyond Meat

- Founder: Ethan Brown

- Product(s): Plant based meat

- 2018 Funding Date: October 5, 2018

- 2018 Funding: $50,000,000

- Total Funding: $122,000,000

- Disclosed Investors: 301 Inc., DNS Capital, GlassWall Syndicate, Kleiner Perkins Caufield & Byers, New Crop Capital, Obvious Ventures, S2G Ventures, Stray Dog Capital, Tyson New Ventures, Cleveland Avenue, Collaborative Fund, Ambrosia Investments, Blue Horizon

- Comments: Beyond Meat is a fascinating player among the truly believable meat replacement startups. Unlike Impossible Foods, whose go to market strategy has been to partner with premium branded on-premise chains where they guide distribution and preparation standards, Beyond Meat has been faster to mass market and is already in 30,000 stores and had a phenomenal IPO in 2019. It’ll be interesting to see if they can lock in brand loyalty from most customers before Impossible Foods, Memphis Meats and others can achieve similar scale.

Bhakti Chai

- Founder: Brook Eddy

- Product(s): Chai beverages

- 2018 Funding Date: August 15, 2018

- 2018 Funding: $2,184,028

- Total Funding: $11,312,965

- Disclosed Investors: CircleUp, Colorado Impact Fund, Red Idea Partners, The R Group, Cleveland Avenue, TAP Ventures

Biena

- Founder: Poorvi Patodia

- Product(s): Chickpea snacks

- 2018 Funding Date: April 19, 2018

- 2018 Funding: $2,350,000

- Total Funding: $4,450,000

- Disclosed Investors: Blueberry Ventures, Centerman Capital, New Ground Ventures, Tastemaker Capital

Birch Benders

- Founders: Matt LaCasse, Lizzi Ackerman

- Product(s): Pancake and waffle mixes

- 2018 Funding Date: June 7, 2018

- 2018 Funding: $5,050,000

- Total Funding: $5,050,000

- Disclosed Investors: Boulder Food Group (BFG)

Blue Crate

- Founder: Kristy Halderman

- Product(s): Oat milk

- 2018 Funding Date: March 1, 2018

- 2018 Funding: $20,000

- Total Funding: $20,000

- Disclosed Investors: Union Kitchen

BlueNalu

- Founder: Lou Cooperhouse

- Product(s): Cell-cultured seafood

- 2018 Funding Date: August 15, 2018

- 2018 Funding: $4,500,000

- Total Funding: $4,500,000

- Disclosed Investors: Clear Current Capital, New Crop Capital

Blume Honey Water

- Founders: Carla Frank, Michele Meloy Burchfield

- Product(s): Honey water

- 2018 Funding Date: August 30, 2018

- 2018 Funding: $425,000

- Total Funding: $600,000

- Disclosed Investors: Unknown

Bobo’s Oat Bars

- Founder: Beryl Stafford

- Product(s): Bars

- 2018 Funding Date: September 6, 2018

- 2018 Funding: $8,000,000

- Total Funding: $16,000,000

- Disclosed Investors: Ridgeline Ventures, Boulder Investment Group Reprise (BIGR Ventures)

Bodega Luigi Bosca

- Founder: Leoncio Arizu

- Product(s): Wine

- 2018 Funding Date: December 18, 2018

- 2018 Funding: Unknown

- Total Funding: Unknown

- Disclosed Investors: L Catterton

Bonafide Provisions

- Founder: Sharon Brown

- Product(s): Bone broth

- 2018 Funding Date: July 27, 2018

- 2018 Funding: $2,250,000

- Total Funding: $6,750,000

- Disclosed Investors: AccelFoods, Boulder Investment Group Reprise (BIGR Ventures), Ridgeline Ventures, Blueberry Ventures

BOU

- Founder: Robert Jakobi

- Product(s): Bouillon cubes and soup cups

- 2018 Funding Date: November 14, 2018

- 2018 Funding: $4,000,000

- Total Funding: $7,800,000

- Disclosed Investors: AccelFoods, Nebari Ventures, Torch Capital, FounderMade Fund, 25Madison

- Comments: Just when it seems every category has been disrupted, it turns out there are still battles just beginning. Case in point: bouillon cubes, which most consumers consider a mainstay of their grandma’s soup recipe. Nonetheless, the elevated branding and better-for-you ingredient profile of BOU should help them battle incumbents like Knorr.

Braven Brewing

- Founders: Marshall Thompson, Eric Feldman

- Product(s): Craft beer.

- 2018 Funding Date: July 11, 2018

- 2018 Funding: $124,900

- Total Funding: $1,009,900

- Disclosed Investors: Unknown

Brew Dr. Kombucha

- Founder: Matt Thomas

- Product(s): Kombucha

- 2018 Funding Date: February 6, 2018

- 2018 Funding: Unknown

- Total Funding: $1,000,000

- Disclosed Investors: Castanea Partners

Brooklyn Gin

- Founders: Emil Jättne, Joe Santos

- Product(s): Gin

- 2018 Funding Date: January 1, 2018

- 2018 Funding: Unknown

- Total Funding: $1,550,000

- Disclosed Investors: QC Ventures

Buff Bake

- Founders: Ashley Boeckle, Brittany Boeckle

- Product(s): High protein cookies and spreads

- 2018 Funding Date: February 28, 2018

- 2018 Funding: Unknown

- Total Funding: Unknown

- Disclosed Investors: AccelFoods

Bulletproof

- Founder: Dave Asprey

- Product(s): Keto coffee and supplements

- 2018 Funding Date: August 1, 2018

- 2018 Funding: $40,000,000

- Total Funding: $68,000,000

- Disclosed Investors: CAVU Ventures, Trinity Ventures, _able

- Comments: Stemming from Dave Asprey’s audaciously titled 2014 book, “The Bulletproof Diet: Lose up to a Pound a Day, Reclaim Energy and Focus, Upgrade Your Life,” the brand offers, “high performance food, drinks & supplements to power your life.” It remains to be seen whether its current fanatical following will translate into long-term success, with one potential pitfall being that “Diets Do Not Make Good Investments.” Bulletproof’s core coffee line will also be competing with the other darling child of cold brew, nitro, which offers a latte like experience without calories, fat or other additives. Which do you prefer?

Caledonia Spirits

- Founder: Todd Hardie

- Product(s): Craft spirits

- 2018 Funding Date: February 21, 2018

- 2018 Funding: $1,250,000

- Total Funding: $1,250,000

- Disclosed Investors: FreshTracks Capital

Califia Farms

- Founder: Greg Steltenpohl

- Product(s): Plant based milks, juice and coffee

- 2018 Funding Date: July 2, 2018

- 2018 Funding: $50,000,000

- Total Funding: $100,000,000

- Disclosed Investors: Stripes Group, Ambrosia Investments

California Dreamin’

- Founder: Amy Ludlum

- Product(s): Cannabis infused soda

- 2018 Funding Date: July 30, 2018

- 2018 Funding: $2,300,000

- Total Funding: $2,300,000

- Disclosed Investors: Babel Ventures

Cardinal Spirits

- Founder: Adam Quirk

- Product(s): Craft spirits.

- 2018 Funding Date: September 28, 2018

- 2018 Funding: $126,000

- Total Funding: $126,000

- Disclosed Investors: Unknown

Caulipower

- Founder: Gail Becker

- Product(s): vegetable-based pizzas and pizza crusts

- 2018 Funding Date: December 20, 2018

- 2018 Funding: $8,200,000

- Total Funding: $10,200,000

- Disclosed Investors: Boulder Food Group (BFG)

Cave Shake

- Founders: Holly Heath, Billie Cavallaro

- Product(s): Keto, vegan, ready-to-drink shake

- 2018 Funding Date: August 31, 2018

- 2018 Funding: Unknown

- Total Funding: Unknown

- Disclosed Investors: L.A. Libations

Cece’s Veggie Noodle Co.

- Founder: Mason Arnold

- Product(s): Veggie noodles

- 2018 Funding Date: December 10, 2018

- 2018 Funding: Unknown

- Total Funding: $14,000,000

- Disclosed Investors: Encore Consumer Capital

Cheating Gourmet

- Founders: Jon Demers, Scott Demers

- Product(s): Premium seafood appetizers

- 2018 Funding Date: April 11, 2018

- 2018 Funding: $1,300,000

- Total Funding: $2,100,000

- Disclosed Investors: Arbel Growth Partners

Chef’s Cut

- Founders: Blair Swiler, Dennis Riedel

- Product(s): Jerky

- 2018 Funding Date: March 31, 2018

- 2018 Funding: $8,000,000

- Total Funding: $14,000,000

- Disclosed Investors: CAVU Ventures, Clearlake Capital, Halen Brands, Rocana Venture Partners, Fort Ventures, Grays Peak Capital

Cherryvale Farms

- Founder: Lindsey Rosenberg

- Product(s): Baked muffin bars

- 2018 Funding Date: June 1, 2018

- 2018 Funding: Unknown

- Total Funding: Unknown

- Disclosed Investors: Unknown

Chirps Chips

- Founders: Laura D’Asaro, Meryl Natow, Rose Wang

- Product(s): Cricket flour tortilla chips

- 2018 Funding Date: June 13, 2018

- 2018 Funding: $25,000

- Total Funding: $75,000

- Disclosed Investors: Unknown

Chloe’s Fruit

- Founder: Michael Sloan

- Product(s): Fruit pops

- 2018 Funding Date: August 4, 2018

- 2018 Funding: $9,000,000

- Total Funding: $13,000,000

- Disclosed Investors: Chobani Food Incubator

Clio

- Founder: Sergey Konchakovskiy

- Product(s): Chocolate covered Greek yogurt

- 2018 Funding Date: June 1, 2018

- 2018 Funding: $5,000,000

- Total Funding: $5,000,000

- Disclosed Investors: Alliance Consumer Growth

COCO5

- Founder: Scott Sandler

- Product(s): Coconut water

- 2018 Funding Date: March 12, 2018

- 2018 Funding: $1,500,000

- Total Funding: $1,500,000

- Disclosed Investors: Spiral Sun Ventures

Coolhaus

- Founders: Natasha Case, Freya Estrelle

- Product(s): Ice cream sandwiches

- 2018 Funding Date: August 29, 2018

- 2018 Funding: $27,500,000

- Total Funding: $38,500,000

- Disclosed Investors: Sunrise Strategic Partners

Copper Cow

- Founder: Debbie Mullin

- Product(s): Portable pour over Vietnamese coffee

- 2018 Funding Date: December 4, 2018

- 2018 Funding: $3,000,000

- Total Funding: $3,000,000

- Disclosed Investors: Victress Capital

Country Archer Jerky Co.

- Founder: Eugene Kang

- Product(s): Jerky

- 2018 Funding Date: September 19, 2018

- 2018 Funding: $10,000,000

- Total Funding: $21,000,000

- Disclosed Investors: Monogram Capital Partners

Crunchsters

- Founder: Frank Lambert

- Product(s): Mung bean snacks

- 2018 Funding Date: June 19, 2018

- 2018 Funding: $2,581,829

- Total Funding: $2,581,829

- Disclosed Investors: AccelFoods, VG Growth Partners

Cure Hydration

- Founders: Alex Sarkissian, Lauren Picasso

- Product(s): Hydration powders

- 2018 Funding Date: August 31, 2018

- 2018 Funding: Unknown

- Total Funding: Unknown

- Disclosed Investors: Unknown

Dahlicious

- Founder: JD Sethi

- Product(s): Indian style yogurt and lassi

- 2018 Funding Date: March 8, 2018

- 2018 Funding: $4,000,000

- Total Funding: $4,000,000

- Disclosed Investors: Fresh Source Capital, Keen Growth Capital

Dirty Lemon

- Founder: Zak Normandin

- Product(s): Beverages and elixirs

- 2018 Funding Date: December 20, 2018

- 2018 Funding: $15,000,000

- Total Funding: $19,500,000

- Disclosed Investors: Burch Creative Capital, MLC Brands, The Coca-Cola Company: Venture Emerging Brands (VEB), Nebari Ventures, The DTX Company, Mark VC

- Comments: New York City-based Dirty Lemon has been creatively contrarian across multiple fronts. From it’s unique flavors ranging from matcha to charcoal to (briefly) CBD, to its proprietary text-message based ordering system, to its new SoHo based retail outlet, it’s no wonder Coke decided to invest. Dirty Lemon offers a window into the future of products, distribution and retail.

Disruptive Enterprises

- Founder: Mike Hockenberry

- Product(s): Food, beverages, and dietary supplements

- 2018 Funding Date: March 20, 2018

- 2018 Funding: Unknown

- Total Funding: $7,800,000

- Disclosed Investors: One Better Ventures

Dixie Brands

- Founders: Chuck Smith, Tripp Keber

- Product(s): Cannabis products.

- 2018 Funding Date: October 1, 2018

- 2018 Funding: $29,000,000

- Total Funding: $37,000,000

- Disclosed Investors: Irving Investors

Don’t Go Nuts

- Founders: Grey Pinto, Lily Pinto, Jane Pinto, Doug Pinto

- Product(s): Nut free snacks for kids

- 2018 Funding Date: April 10, 2018

- 2018 Funding: $8,440,772

- Total Funding: $8,440,772

- Disclosed Investors: Unknown

Eat Me

- Founders: Amber Odhner, Catelyn Augustine

- Product(s): Plant-based ice cream

- 2018 Funding Date: November 1, 2018

- 2018 Funding: $50,000

- Total Funding: $60,000

- Disclosed Investors: Unknown

Edenworks

- Founder: Jason Green

- Product(s): Fish in aquaponic ecosystems

- 2018 Funding Date: May 31, 2018

- 2018 Funding: $5,000,000

- Total Funding: $5,000,000

- Disclosed Investors: Myca Partners

Ellenos

- Founders: Bob Klein, Yvonne Klein, Con Apostolopoulos, Alex Apostolopoulos

- Product(s): Greek yogurt

- 2018 Funding Date: April 17, 2018

- 2018 Funding: $18,000,000

- Total Funding: $18,000,000

- Disclosed Investors: Monogram Capital Partners

Endless West

- Founder: Alec Lee

- Product(s): Molecular spirits

- 2018 Funding Date: May 31, 2018

- 2018 Funding: $7,020,000

- Total Funding: $9,720,000

- Disclosed Investors: Collaborative Fund, Indie.Bio, Horizons Ventures

- Comments: More than meat-makers can play with molecules. Enter Endless West, which has developed a process to shorten the aging process for spirits from years to days. While it has yet to release a commercial product, the fact that it counts Horizon Investors (also an investor in Impossible Foods) among its biggest backers suggests a bright future for the brand and the category as a whole.

Enduraphin

- Founder: Daniel Drake

- Product(s): Supplements

- 2018 Funding Date: June 7, 2018

- 2018 Funding: Unknown

- Total Funding: Unknown

- Disclosed Investors: Unknown

Fancy Sprinkles

- Founder: Lisa Stelly

- Product(s): Sprinkles

- 2018 Funding Date: September 26, 2018

- 2018 Funding: Unknown

- Total Funding: Unknown

- Disclosed Investors: Sterling Partners

Farmer’s Fridge

- Founder: Luke Saunders

- Product(s): Vending machine meals

- 2018 Funding Date: September 5, 2018

- 2018 Funding: $30,000,000

- Total Funding: $10,600,000

- Disclosed Investors: Danone Manifesto Ventures, Cleveland Avenue, Maywic Select, Spiral Sun Ventures, Powerplant Ventures, DNS Capital, DomCapital Group

Farmwise Foods

- Founders: Dave Peters, Cristina Peters

- Product(s): Frozen veggie snacks

- 2018 Funding Date: April 10, 2018

- 2018 Funding: $4,500,000

- Total Funding: $6,043,097

- Disclosed Investors: Cleveland Avenue, Centerman Capital

FAWEN

- Founders: Amanda Bowen, Fabio Fossati

- Product(s): Ready to drink soup

- 2018 Funding Date: March 1, 2018

- 2018 Funding: $1,500,000

- Total Funding: $1,500,000

- Disclosed Investors: Unknown

Feast & Fettle

- Founders: Carlos Ventura, Maggie Mulvena, Nicole Oliveira

- Product(s): Premium meal delivery service

- 2018 Funding Date: October 1, 2018

- 2018 Funding: $221,000

- Total Funding: $249,000

- Disclosed Investors: Unknown

Feel Good Foods

- Founders: Tryg Siverson, Vanessa Phillips

- Product(s): Asian inspired appetizers and meals

- 2018 Funding Date: June 28, 2018

- 2018 Funding: Unknown

- Total Funding: $355,000

- Disclosed Investors: Crimson Seed Capital, City Capital Ventures

Finless Foods

- Founder: Mike Selden

- Product(s): Fish meat from stem cells

- 2018 Funding Date: June 20, 2018

- 2018 Funding: $3,500,000

- Total Funding: $3,500,000

- Disclosed Investors: Draper Associates, Babel Ventures, Blue Horizon

FitJoy

- Founder: Manish Patel

- Product(s): Bars.

- 2018 Funding Date: January 26, 2018

- 2018 Funding: $5,000,000

- Total Funding: $5,000,000

- Disclosed Investors: LivWell Ventures

Flying Embers

- Founder: Bill Moses

- Product(s): Hard kombucha

- 2018 Funding Date: November 15, 2018

- 2018 Funding: Unknown

- Total Funding: Unknown

- Disclosed Investors: Ecosystem Integrity Fund

- Comments: Anyone that’s ever spiked their kombucha can see the potential for Bill Moses’s latest venture. The founder of Kevita (acquired by Pepsi) is bringing innovation to the alcohol space, which so often feels years behind the broader natural products industry.

Fora

- Founders: Aidan Altman, Andrew McClure

- Product(s): Aquafaba based butter

- 2018 Funding Date: July 26, 2018

- 2018 Funding: $1,400,000

- Total Funding: $1,400,000

- Disclosed Investors: New Crop Capital, Baleine & Bjorn Capital, EverHope Capital, Blue Horizon, Myca Partners, Katjesgreenfood

Fort Point

- Founder: Justin Catalana

- Product(s): Beer

- 2018 Funding Date: July 16, 2018

- 2018 Funding: $7,743,616

- Total Funding: $11,262,616

- Disclosed Investors: CircleUp,Saltwater Capital

Four Sigmatic

- Founders: Tero Isokauppila, Mikko Revonniemi

- Product(s): Mushroom coffee

- 2018 Funding Date: December 11, 2018

- 2018 Funding: $5,377,053

- Total Funding: $5,577,053

- Disclosed Investors: AccelFoods, _able, Eighteen94 Capital

Freeland Spirits

- Founder: Jill Kuehler

- Product(s): Craft spirits.

- 2018 Funding Date: June 15, 2018

- 2018 Funding: $540,000

- Total Funding: $540,000

- Disclosed Investors: Unknown

Fresh Bellies

- Founders: Saskia Sorrosa, Nick Kennedy, Virgi Schiffino

- Product(s): Vegetable based baby food

- 2018 Funding Date: March 9, 2018

- 2018 Funding: $25,000

- Total Funding: $25,000

- Disclosed Investors: Chobani Food Incubator

GIVN Water

- Founders: John Houseal, Liz Skalla

- Product(s): Water

- 2018 Funding Date: October 19, 2018

- 2018 Funding: Unknown

- Total Funding: $700,000

- Disclosed Investors: Wolfpack Brands

Good Catch

- Founders: Chad Sarno, Eric Schnell, Marci Zaroff

- Product(s): Plant based seafood

- 2018 Funding Date: August 7, 2018

- 2018 Funding: $8,700,000

- Total Funding: $8,700,000

- Disclosed Investors: Baleine & Bjorn Capital, New Crop Capital, Stray Dog Capital, M13 Company, MetaBrand Capital, Rocana Venture Partners, EverHope Capital, Clear Current Capital, Blue Horizon

- Comments: While cell based animal products began with meat, companies like Good Catch are also targeting seafood. In light continued worrying reports surrounding over fishing, Good Catch is helping chart a sustainable, delicious future.

Good Day Chocolate

- Founders: Andrew Goldman, Simeon Margolis

- Product(s): Caffeinated chocolate

- 2018 Funding Date: March 1, 2018

- 2018 Funding: Unknown

- Total Funding: $3,120,000

- Disclosed Investors: AccelFoods, Boulder Food Group (BFG), Echo Capital Group

GoodBelly

- Founders: Steve Demos, Todd Beckman

- Product(s): Probiotic juice

- 2018 Funding Date: June 20, 2018

- 2018 Funding: $12,000,000

- Total Funding: $39,200,000

- Disclosed Investors: Emil Capital Partners, Maveron, 301 Inc.

Green Blender

- Founders: Amir Cohen, Jenna Tanenbaum

- Product(s): Smoothie subscription service

- 2018 Funding Date: January 11, 2018

- 2018 Funding: Unknown

- Total Funding: $1,900,000

- Disclosed Investors: Food-X

Grillo’s Pickles

- Founder: Travis Grillo

- Product(s): Pickles

- 2018 Funding Date: March 6, 2018

- 2018 Funding: $3,600,000

- Total Funding: $3,600,000

- Disclosed Investors: Centerman Capital, Breakaway Ventures

Hail Merry

- Founder: Susan O’Brien

- Product(s): Better for you sweet snacks

- 2018 Funding Date: May 15, 2018

- 2018 Funding: $787,200

- Total Funding: $6,800,000

- Disclosed Investors: Evale Holdings, Powerplant Ventures, Blue Horizon, CircleUp

Hangnever

- Founder: Mario Mare

- Product(s): Carbonated anti-hangover drink

- 2018 Funding Date: February 20, 2018

- 2018 Funding: Unknown

- Total Funding: Unknown

- Disclosed Investors: Black Dog Venture Partners

Happy Day Brands

- Founders: Mark Priddy, Jeanette Priddy

- Product(s): Organic coffee, chocolate, superfoods.

- 2018 Funding Date: November 6, 2018

- 2018 Funding: $750,000

- Total Funding: $750,000

- Disclosed Investors: Unknown

Harmless Harvest

- Founders: Justin Guilbert, Douglas Riboud

- Product(s): Coconut water

- 2018 Funding Date: February 1, 2018

- 2018 Funding: $30,000,000

- Total Funding: $30,000,000

- Disclosed Investors: Danone Manifesto Ventures, AccelFoods

Haven’s Kitchen Sauce

- Founder: Alison Kayne

- Product(s): Sauces and condiments

- 2018 Funding Date: September 18, 2018

- 2018 Funding: $25,000

- Total Funding: $25,000

- Disclosed Investors: Chobani Food Incubator

HERE

- Founders: Megan Klein, Nate Laurell

- Product(s): Juices

- 2018 Funding Date: April 13, 2018

- 2018 Funding: $4,000,000

- Total Funding: $4,000,000

- Disclosed Investors: Listen Ventures, Pallasite Ventures

Heritage Distilling

- Founder: Justin Stiefel

- Product(s): Craft spirits.

- 2018 Funding Date: April 17, 2018

- 2018 Funding: $387,200

- Total Funding: $387,200

- Disclosed Investors: Unknown

High Brew

- Founder: David Smith

- Product(s): Coffee

- 2018 Funding Date: May 18, 2018

- 2018 Funding: $20,000,000

- Total Funding: $48,400,000

- Disclosed Investors: Boulder Investment Group Reprise (BIGR Ventures), CAVU Ventures, Tasty Ventures, Charles Street Partners

- Comments: High Brew has seen some high growth as the cold brew category continues to explode. They’ve also dipped their toes into the protein and coffee subset, which brands such as Kitu Life are focusing on full time. It’ll be fascinating to see which areas under the cold brew umbrella, from butter to protein to alternative dairy, perform best.

Hippeas

- Founder: Livio Bisterzo

- Product(s): Chickpea puffs

- 2018 Funding Date: December 21, 2018

- 2018 Funding: $12,000,000

- Total Funding: $22,000,000

- Disclosed Investors: CAVU Ventures, Green Park Brands, Strand Equity Partners

- Comments: Hippeas has a visionary founder who has created one of the most successful launches in industry history. From starting in mid-2016, Hippeas has closed two rounds from top tier firms and with participation from the likes of Leo DiCaprio, presciently built its snacks using the deservedly on-trend chickpea and was generating monthly revenue of nearly $1,000,000 barely a year post launch. Part of their success has been understanding The ROI of Surprise and Delight.

Hu Products

- Founders: Jason Karp, Jordan Brown, Jessica Karp

- Product(s): Chocolate, nuts and coffee

- 2018 Funding Date: May 15, 2018

- 2018 Funding: $10,000,000

- Total Funding: $10,000,000

- Disclosed Investors: Sonoma Brands, Vanterra Accelerator Fund

Humm Kombucha

- Founder: Jamie Danek

- Product(s): Kombucha

- 2018 Funding Date: March 15, 2018

- 2018 Funding: $10,000,000

- Total Funding: $27,600,000

- Disclosed Investors: VMG Partners

Hungryroot

- Founders: Franklin Becker, Gregory Struck, Benjamin McKean

- Product(s): Plant based delivered meals

- 2018 Funding Date: March 22, 2018

- 2018 Funding: $22,000,000

- Total Funding: $35,900,000

- Disclosed Investors: Brooklyn Bridge Ventures, Great Oaks Venture Capital, jab Brands, KarpReilly, Lerer Hippeau Ventures, Lightspeed Venture Partners

Icelandic Provisions

- Founders: Polaris Founders Capital, Mjólkursamsalan

- Product(s): Icelandic yogurt

- 2018 Funding Date: May 16, 2018

- 2018 Funding: $5,000,000

- Total Funding: $29,100,000

- Disclosed Investors: Unknown

ICONIC

- Founder: Billy Bosch

- Product(s): Protein drinks

- 2018 Funding Date: September 10, 2018

- 2018 Funding: $4,000,000

- Total Funding: $13,000,000

- Disclosed Investors: AccelFoods, KarpReilly

Impossible Foods

- Founder: Patrick Brown

- Product(s): Plant based meat

- 2018 Funding Date: April 4, 2018

- 2018 Funding: $114,000,000

- Total Funding: $427,000,000

- Disclosed Investors: Collaborative Fund, Horizons Ventures, Khosla Ventures, Blue Horizon

- Comments: As an avowed carnivore, my first bite of the Impossible Burger was the most memorable food experience of my life. Beyond multi-star Michelin hauts or the fantastic pizza of Brooklyn, the likeliness of Bareburger’s rendition to the real deal cannot be overstated. Goldman Sachs recently declared “meatless meats” as one of “8 Huge Trends That Are About to Change the World” and companies like Impossible are turning the future into reality.

IQ Bar

- Founder: Will Nitze

- Product(s): Bars

- 2018 Funding Date: June 8, 2018

- 2018 Funding: $400,000

- Total Funding: $400,000

- Disclosed Investors: Unknown

Ithaca Cold Crafted

- Founder: Chris Kirby

- Product(s): Hummus

- 2018 Funding Date: September 18, 2018

- 2018 Funding: $25,000

- Total Funding: $2,725,000

- Disclosed Investors: Chobani Food Incubator

JJ’s Sweets

- Founder: JJ Rademaekers

- Product(s): Coconut milk caramels

- 2018 Funding Date: February 1, 2018

- 2018 Funding: Unknown

- Total Funding: $1,170,000

- Disclosed Investors: AccelFoods

Joechocolates

- Founders: Sam Tanner, Peter Keckemet

- Product(s): High caffeine chocolate

- 2018 Funding Date: July 10, 2018

- 2018 Funding: $705,000

- Total Funding: $705,000

- Disclosed Investors: Unknown

Jos. A. Magnus & Co.

- Founder: Joseph Magnus

- Product(s): Craft spirits

- 2018 Funding Date: December 5, 2018

- 2018 Funding: $2,850,000

- Total Funding: $2,850,000

- Disclosed Investors: Unknown

Keen Bean Organics

- Founder: Johnny Kien

- Product(s): Kid food pouches

- 2018 Funding Date: September 14, 2018

- 2018 Funding: Unknown

- Total Funding: Unknown

- Disclosed Investors: Capital Innovators, Food Evolutions, Yara Ventures

Kettle and Fire

- Founders: Nick Mares, Justin Mares

- Product(s): Bone broth

- 2018 Funding Date: August 28, 2018

- 2018 Funding: $8,000,000

- Total Funding: $9,000,000

- Disclosed Investors: Chobani Food Incubator, Hedgewood, Encore Consumer Capital, Rocana Venture Partners, CAVU Ventures

Kettlebell Kitchen

- Founders: Andrew Lopez-Gallego, Andy Lopez-Gallego, Gregory Grossman, Joseph Lopez-Gallego

- Product(s): Gym focused meal delivery service

- 2018 Funding Date: October 9, 2018

- 2018 Funding: $26,700,000

- Total Funding: $30,400,000

- Disclosed Investors: North Castle Partners, Spring Bay Ventures

Kite Hill

- Founders: Tal Ronnen, Monte Casino, Patrick Brown

- Product(s): Almond based yogurt and cheese

- 2018 Funding Date: October 19, 2018

- 2018 Funding: $40,000,000

- Total Funding: $74,900,000

- Disclosed Investors: 301 Inc., CAVU Ventures, Stray Dog Capital, Khosla Ventures, M13 Company, New Crop Capital, Whole Foods

- Comments: The massive funding round corresponds to the growth of plant-based cheese and plant-based yogurt overall, which topped $280 million in combined sales as of June 2018 according to data from Nielsen. Nonetheless, Kite Hill faces stiff competition from brands like Califia and Miyoko’s Kitchen.

Kitu Life

- Founders: Jim DeCicco, Jake DeCicco, Jordan DeCicco

- Product(s): Keto coffee

- 2018 Funding Date: December 5, 2018

- 2018 Funding: $13,500,000

- Total Funding: $15,411,000

- Disclosed Investors: Echo Capital Group, Anthos Capital, Skyview Capital

Kiva Confections

- Founder: Scott Palmer and Kristi Knoblich.

- Product(s): Cannabis gummies and bars

- 2018 Funding Date: August 1, 2018

- 2018 Funding: $8,560,000

- Total Funding: $15,059,999

- Disclosed Investors: Unknown

Kumana

- Founder: Francisco Pavan

- Product(s): Avocado sauces

- 2018 Funding Date: May 14, 2018

- 2018 Funding: Unknown

- Total Funding: Unknown

- Disclosed Investors: Springboard

Kyoku

- Founders: Harrison Valner, Ryan Roddy

- Product(s): Plant based supplements

- 2018 Funding Date: November 14, 2018

- 2018 Funding: $100,000

- Total Funding: $100,000

- Disclosed Investors: Unknown

Lavva

- Founder: Liz Fisher

- Product(s): Plant-based yogurt

- 2018 Funding Date: November 1, 2018

- 2018 Funding: $2,300,000

- Total Funding: $5,800,000

- Disclosed Investors: ASW Ventures, S2G Ventures, Collaborative Fund

Laws Whiskey House

- Founder: Al Laws

- Product(s): Whiskey

- 2018 Funding Date: June 27, 2018

- 2018 Funding: Unknown

- Total Funding: Unknown

- Disclosed Investors: First Beverage Group

Lazy Gator’s Hemp Farm

- Founder: Dennis Williams

- Product(s): Hemp oil.

- 2018 Funding Date: December 12, 2018

- 2018 Funding: $165,000

- Total Funding: $165,000

- Disclosed Investors: Unknown

LesserEvil

- Founder: Charles Coristine

- Product(s): Popcorn and potato chips

- 2018 Funding Date: November 19, 2018

- 2018 Funding: $1,800,000

- Total Funding: $1,800,000

- Disclosed Investors: InvestEco

Lily’s Sweets

- Founders: Cynthia Tice, Chuck Genuardi