Image Source: LA Times

Every week we track the business, tech and investment trends in CPG, retail, restaurants, agriculture, cooking and health, so you don’t have to. Here are some of this week’s top headlines.

In the week following Trump’s executive order directing meatpacking plants to remain open, confirmed COVID-19 cases jumped 40% in counties with major beef or pork slaughterhouses, compared with a 19% rise nationally. Nearly 12,000 meat plant workers have tested positive, and 48 have died thus far. In response to the crisis, Democrats are renewing a push to phase out factory farming by 2040.

In the latest consolidation play, Uber has made an offer to acquire Grubhub at $6.9 billion, a move that many hope will hit a reset button on an industry that is both overpriced and unprofitable. Meanwhile, the New York City Council has passed a bill that caps delivery fees to 20%.

The COVID-19 pandemic has put more than 10 million independent restaurant workers at risk of losing their jobs for good. Across sectors, businesses are being forced to pivot their business models as consumers go on lockdown and change their buying habits. This round-up features many of the ways the pandemic is impacting all parts of the food industry.

In an effort to do our part and support the community we love so dearly, we have compiled a list of resources and organizations that are providing support to those in need. We are also offering free job postings to anyone who is looking to employ people impacted by the COVID-19 pandemic.

- Resources: We have compiled a database of resources for those in the food industry impacted by the pandemic here. Please add your own resources as well.

- Jobs: We need to band together to support everyone across the food system who has lost their job due to the pandemic. Use code “coronavirusfoodjobs” to post remote or remote-friendly food jobs on our job board for free.

We need your support as well. Producing our newsletter takes a lot of time and resources, and we need to change our business model to keep it going. To date, we’ve funded our work through our events, sponsorships and consulting, which are all on hold due to the pandemic. If you find our newsletter to be a valuable resource, we hope you will consider making a one time or monthly contribution, so we can keep the newsletter going and free for those who can not afford a subscription fee. Whether it’s $5 or $500 every bit helps and shows us that you value our work. Not able to contribute right now? You can help by sharing our newsletter with friends and colleagues.

Check out our weekly round-up of last week’s top food startup, tech and innovation news below or peruse the full newsletter here.

1. Infections Near U.S. Meat Plants Rise at Twice National Rate – Bloomberg

Confirmed Covid-19 cases jumped 40% during the week following the order in counties with major beef or pork slaughterhouses, compared with a 19% rise nationally.

2. Uber’s Grubhub Play: A Desperate Bid to Save a Business Everyone Hates – Forbes

The offer, which could value Grubhub at $6.9b, would give Uber Eats 55% of the delivery market with the addition of 24m active users and usher in a new wave of consolidation that many hope will hit a reset button on an industry that is both overpriced and unprofitable.

3. Almost 12,000 Meatpacking and Food Plant Workers Have Reportedly Contracted COVID-19. At Least 48 Have Died. – Business Insider

The cases and deaths are spread across roughly two farms and 189 meat and processed food factories, according to the Food and Environment Reporting Network.

4. Booker Renews Push to Phase Out Factory Farming by 2040 After Pandemic Hits Meatpacking Plants – The Hill

On Wednesday, Elizabeth Warren announced she is co-sponsoring the bill and Ro Khanna is introducing a companion bill in the House. The legislation directly targets multinational meat producing giants, such as Smithfield Foods, Tyson Foods and JBS.

5. Meat Plant Closures Mean Pigs Are Gassed or Shot Instead – New York Times

Coronavirus outbreaks at meatpacking plants have created a backlog of animals ready for slaughter but with nowhere to go. Farmers are having to cull them.

6. As Coronavirus Spreads in Meat Plants, Nearly 200 USDA Inspectors Test Positive – Food Dive

The American Federation of Government Employees, a union representing 6,500 federal food inspectors, said three inspectors have died in Illinois, Mississippi and New York.

7. US Meat Plant Changes Signal End of the 99-Cent Chicken – Bloomberg

The human cost of producing 99-cent chickens and affordable burgers during a pandemic is pushing US meatpackers to eye major operational changes that will likely make American meat more costly.

8. As US Meat Workers Fall Sick and Supplies Dwindle, Exports to China Soar – Reuters

Trump is facing criticism from some lawmakers, consumers and plant employees for putting workers at risk in part to help ensure China’s meat supply.

9. Grocery Wars: A Natural Foods Reckoning

Elly Truesdell, partner at Almanac Insights and former global director of local brands and product innovation at Whole Foods Market, says a reckoning is coming for the natural foods industry as Big Food experiences a comeback. A movement that began with substance – offering new and better products for personal and environmental health – has lost its way and must do better, she argues.

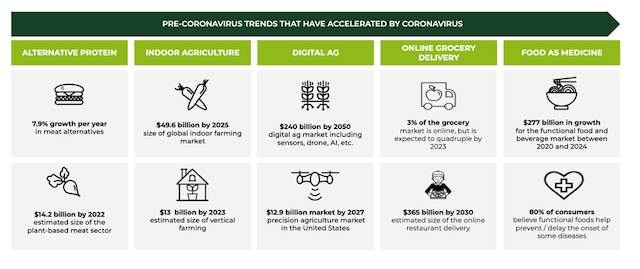

10. $930M Invested in Alternative Proteins in Q1 2020 Tops Record-Setting 2019 Totals – Food Dive

Not only is this a record amount of funding, but investment in the first three months of this year exceeds the $824m invested in the segment in all of 2019 by 11%.

11. As Restaurants Struggle, Cities Look to Cap Delivery Fees – Politico

City councils in New York City, Chicago, Los Angeles and Boston are considering commission caps as low as 5 percent. Washington, D.C., Seattle and San Francisco already adopted emergency orders that limit commissions to 15 percent.

12. City Council Doubles Delivery Fee Cap to 20% for Some Restaurants – Eater

The bill now stipulates a 5% baseline fee cap on all orders placed through the delivery platforms, preventing the third-party services from charging additional large fees for marketing services. Commission fees will now be capped at 15%.

13. Americans Keep Clicking to Buy, Minting New Online Shopping Winners – New York Times

Online sales in the United States have surged in recent weeks, after shelter-in-place measures enacted in March shuttered brick-and-mortar stores throughout the country. In grocery, the clear winner so far has been Instacart.

14. Reopening | The Impact of Rehiring on Unemployment Benefits – Oyster Sunday

Recommendations for employees and employers, including how to navigate unemployment insurance and Pandemic Unemployment Assistance, potential implications on Payroll Protection Program loans and more.

15. After 30 Years of Being Shut Out, the Small Business Administration Just Allowed Farmers to Apply for Economic Disaster Loans – The Counter

Small-scale farmers are cautiously hopeful about this new funding source. They also worry it’s too little, too late.

16. Trump’s Executive Order Seeks Controversial Overhaul of Seafood Industry – The Fern

Offshore aquaculture, which has long divided environmentalists and commercial fishing interests, now has a pathway to approval.

17. Indonesia: Jay-Z, Serena Williams-Backed Kopi Kenangan Scores $109M in Sequoia-Led Series B Round – AgFunder

Sequoia Capital India led the round. The startup will use funds to launch new products, enhance its tech base and expand its operations in its native Indonesia.

18. Slice, an Online Ordering and Marketing Platform for Pizzerias, Raises $43M – TechCrunch

KKR led the round. New funding will go towards bringing on more pizzerias.

19. Tock Raises $10M to Help Fancy Restaurants Do Takeout – CNBC

Valor Siren Ventures led the round. In addition to restaurants, Tock is also now providing its technology to farms so they can sell bags of fresh produce directly to consumers.

20. Trump Says US Will Purchase $3B in Agricultural Products From Farmers – The Hill

The U.S. will purchase $3 billion of dairy, meat and produce from farmers and ranchers starting early this week, Trump announced on Saturday.

21. McDonald’s Workers in Denmark Pity Us – The New York Times

In Denmark, McDonald’s starting pay is $22/hour, including 6 weeks of paid vacation, life insurance, 1 year of paid maternity leave and a pension plan.

22. Amazon Has Quietly Started a Free Delivery Service for Restaurants Housed In Its Buildings – Eater

Drivers who used to shuttle corporate employees around are part of the program.

23. Target to Aquire Deliv Tech as the Last-Mile Startup Shuts Down – Grocery Dive

Target will acquire Deliv’s proprietary technology that assists in the batching and routing of orders.

24. Trump Says US Will Purchase $3B in Agricultural Products From Farmers – The Hill

The U.S. will purchase $3 billion of dairy, meat and produce from farmers and ranchers starting early this week, Trump announced on Saturday.

25. Alison Roman, the Colonization of Spices, and the Exhausting Prevalence of Ethnic Erasure in Popular Food Culture – Pajiba

An important look at a big, prevalent problem in today’s food culture. Learn more about the controversy here.

Our newsletter is the absolute easiest way to stay on top of the emerging sector, so sign up for it today and never miss the latest food tech and innovation news and trends, Already signed up? Share the love with your friends and colleagues!

The post Infections In US Meat Plants 2x National Rate, Uber Woos Grubhub + More appeared first on Food+Tech Connect.

Source: NBC News

Source: NBC News