![]()

This is a guest post by Errol Schweizer, Host of The Checkout Podcast, Co-Founder, Board Member For Natural Products Retail and CPG, Writer at Forbes.com and Former Whole Foods VP of Grocery.

Mastered economics ’cause you took yourself from squalor

Mastered academics ’cause your grades say you a scholar

Mastered Instagram ’cause you can instigate a follow

Look at all these slave masters posin’ on yo’ dollar

-JU$T by Run The Jewels

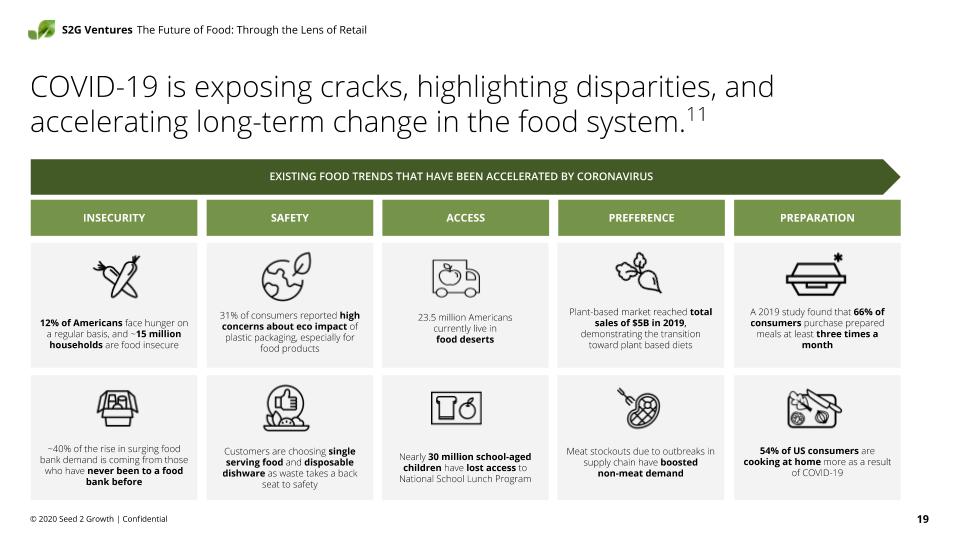

Covid-19 is the first real stress test that our food system and supply chains have experienced in the 21st century. The pandemic highlighted the deep fissures in the industry and ripped away the pretense of “sustainable food”, and showed that we have made little progress moving past our food system’s origins in plantation slavery, Native American genocide and land theft. The impacts of Covid-19 in the food and agriculture sectors have been felt most acutely by the essential workers foundational to the supply chain. Considering the potential impacts of the climate change related crises that are sure to come, we have our work cut out if we are to fulfill a vision of a more just, sane and sustainable food system.

We have a responsibility to all stakeholders in our supply chains to pursue deep and substantive change, starting with the social and economic issues that underlie how we grow, make, distribute and sell food. Our inability to accomplish this mission so far has enabled catastrophic death, sickness and misery during Covid-19. Is this the best we can do?

We’ve Failed Our Food Workers

No stakeholder group has carried a greater burden during Covid-19 than essential workers in food service, retail, manufacturing and CPG. The latest data show that almost 83,000 supply chain workers have been sickened with the virus, and over 360 have died. This data doesn’t come near to illustrating the shocking impact of the pandemic on all supply chain workers, such as the hundreds of frontline retail workers that have also died, according to UFCW.

The federal government failed to protect these workers, and even put them in harms way. OSHA, the agency tasked with protecting workers on the job, completely failed in its role, refusing to issue an enforceable emergency temporary standard. And the Trump Administration exacerbated the dangerous conditions by issuing an executive order last April, at the behest of big meat monopolies, forcing meat plants to stay open despite the rapid transmission of Covid within the plants. The administration later releasing guidance to increase line speeds, which surely sped virus transmission in dirty, crowded facilities staffed by exhausted personnel.

It’s not as though things were hunky-dory before March 2020. Essential workers have faced decades of wage stagnation. If wages had kept pace with productivity, we would have a $24 an hour minimum wage, and not still be haggling for a $15 an hour floor. Seen from another angle, working and middle class people have been robbed of nearly $50 trillion in income since 1975, or over $2.5 Trillion annually. Meanwhile, the top 1 percent of income earners have increased their share from 9 percent to 22 percent in that timeframe, while the bottom 90 percent have seen their share fall from 67 percent to 50 percent. In a year of Black Lives Matter-catalyzed reckonings of race and inequality, do I even need to mention that it’s mostly old white dudes who inhabit that top income bracket? They made money the old-fashioned way, LOL.

The pandemic-induced economic crisis exacerbated these conditions. While over 400,000 died, 67 million folks lost work, 98,000 businesses closed and 1 in 6 Americans, over 54 Million people, were struggling with food insecurity, the Dow hit 30,000 and the collective wealth of 650 billionaires increase by $1 Trillion to over $4 Trillion, nearly double the wealth of the bottom 165 million Americans. And while thousands of individuals, enterprises and non-profits have mobilized to take care of their customers, workers and communities, retailers at the commanding heights of the food system and supply chain leveraged the pandemic to generate enormous profits for a small handful of shareholders and executives, while sharing little with the workers that kept everything going. The wealth of the Walton family alone has grown by $40.7 billion during the pandemic, nearly 26 times the amount of all hazard pay for all 1.5 million Wal-Mart associates in the same timeframe, putting to rest forever the misguided notion that better pay would result in higher prices.

But as Arundhati Roy has written, the pandemic is a portal, a gateway between one world and the next.

What could that portal lead to in our corner of the economy, in supply chains and the food system?

First, Breathe.

Next, I’d have a banner over that gateway, quoting legendary East Village artist Seth Tobocman, “You don’t have to fuck people over to survive.”

Then I’d start some civil, yet uncomfortable conversations around what we could do to create and build this fair, just, sane food system and supply chain. The following is a discussion guide to help inform those conversations. You can also join us for Food+Tech Connect’s Reimagining Food Retail Conversation Series and Slack group to have these conversations. Let me know in the comments or on Twitter @grocery_nerd or Instagram @grocery.nerd how it goes.

Got a Vonnegut punch for your Atlas shrugs

-El-P

![]()

1. A Seat at the Table

Retailers need to give food workers a seat a the table. Unions, the folks that brought us the weekend. Unions, the folks that built the middle class. I grew up around family members, friends and neighbors that were unionized. But what a paradigm, shift I experienced in the natural products sector, not only a curious antipathy to organized labor, but an outright denial of the role that unions have played in our society. It was like another dimension, where the bosses, benevolent for the moment, knew best. Obviously, that moment passed.

Is it any coincidence that the extreme wealth and income inequalities since 1975 paralleled a similar decline in unionization rates, particularly in the private sector? On the other hand, unions have delivered impressive wins for their members during Covid-19, in particular the Teamsters, UFCW and RWDSU, while also advocating for all essential workers to have hazard pay, living wages, paid sick leave and safer work environments. And workers in supply chain and retail sectors have been getting more restive given the conditions they face, walking out or going on strike to win better gains from employers. As I have written elsewhere , this year promises to be very interesting on the labor front, and history has proven the value of unions for working people, in particular women and BIPOC folks. Black people in particular have much higher wages, better health insurance and pensions when unionized. The PRO-Act, which passed the House a year ago, is the most important piece of pro-worker legislation in decades, promising to introduce enforceable penalties for companies that violate workers’ rights, expanding workers’ collective bargaining rights and strengthening workers’ access to fair union elections. Or as Abe Lincoln once said, “Labor is prior to, and independent of, capital. Capital is only the fruit of labor, and could never have existed if labor had not first existed. Labor is the superior of capital, and deserves much the higher consideration.”

Let’s Discuss: We need to reconsider the resistance to and avoidance of unions and worker’s solidarity. They have proven far and away to have been the best allies for all working people during the pandemic and deserve a seat at the table. What role can your organization play in the struggle for worker’s justice?

![]()

2. Farm Worker Justice

We have long exploited farm workers, and a just and sustainable future requires that we rethink the way we treat and pay them. None of us could eat without them. Yet they are among the most exploited and under appreciated members of our supply chain, lacking the basic labor protections that the rest of us take for granted. In 1938, the Fair Labor Standards Act established workplace protections, such as the minimum wage, a 40-hour work week, overtime pay and a ban on child labor. To pass this bill, however, FDR needed to appease Southern Dixiecrats who didn’t want to compensate their workers fairly, so they left farmworkers (and domestic workers) out of the bill because they were primarily Black. Now farmworkers, who are majority Latin American and immigrant, have been exploited by generations of farmers big and small and consumers have been inured to prices not taking into account the dignity and wellbeing of farmworkers.

Vice President Kamala Harris, whose home state of California passed overtime pay for farmworkers in 2016, has introduced legislation, called the Fairness for Farm Workers Act, that would mandate overtime and end minimum-wage and overtime exemptions. A recent study in Massachusetts added credibility to this bill, concluding that giving workers overtime pay would add just 2 percent to farmgate cost, meaning that while it could easily be amortized into a rounding error by the time a product got to the consumer, it would also mean a 17 percent pay bump for farmworkers. According to Foodtank, farmworker advocacy groups such as Alianza Nacional de Campesinas and National Young Farmers Coalition (NYFC) are collaborating to help secure protections for farm workers impacted by Covid-19. In a letter to congress, Alianza de Campesinas articulated critical concerns: the exclusion of food system workers from relief, addressing food supply disruptions, and the lack of healthcare and economic assistance for marginalized communities, as well as the resurgence of sexual violence faced by women farmworkers. Farmworker justice exists at the intersection of race, gender and class in the food system, and literally none of us would be here now without these folks who are growing and harvesting our food, so it’s time we looked out for them and treated them with the respect and dignity they deserve.

Let’s Discuss: What can we do to ensure that farmworkers are compensated fairly and treated with dignity, even if that means making adjustments to cost structures and value propositions that have been built upon their stress and exploitation?

![]()

3. Confront White Supremacy

I once remarked to Carla Vernón, vice president of consumables at Amazon, that I’ve attended many natural products meetings that were whiter than Ku Klux Klan rallies. And author Raj Patel has a test that he gives food companies: if the Klan took over your business or your board of directors, how much would they have to change?

As context, Julie Guthman writes, in the United States “land was virtually given away to whites at the same time as reconstruction failed in the South, Native American lands were appropriated, Chinese and Japanese were precluded from landownership, and the Spanish-speaking Californios were disenfranchised on their ranches.” This pattern was repeated in the 20th century, as thousands of Black farmers were displaced or chased off the farms they built after Reconstruction. The consolidation of this rural land for conventional agribusiness production, as well as the cheapness and availability of it for the back-to-the land counterculture that gave rise to the natural products trade, both further entrenched land ownership and food production by and for white people. Is it any wonder that the organic/regenerative sector idolizes Wendell Berry, Sir Albert Howard, or this guy but rarely mentions George Washington Carver, Booker T. Whatley, or Fannie Lou Hamer ?

The point here is that white supremacy is pervasive in the food industry, not only in terms of the ownership, management and governance of most major food and supply chain enterprises, but also in terms of the values, priorities and belief systems. From the conditioned belief in bootstrap individualism that blames health and wellness outcomes on individual lifestyle choices, to the persistent, nagging paternalism of NGO’s and CEO’s telling BIPOC folks what they should be eating. Or the dominant economic dogma that such problems can only be resolved by competition and free markets, like opening glitzy chain stores in gentrifying neighborhoods. It is no wonder that retail stores are heavily policed spaces of racialized trauma, as Dr. Naya Jones says. If I had a dime for every time I heard or experienced a white supremacist-rooted trope in a respectable retail setting over the past 20 years, I’d be retired by now. And it’s very rare that I have worked with any outright sieg-heil’ing knuckle-draggers. The casualness makes it that much more insidious and tough to address.

But those of us who present as white have the most work to do here: we must confront our privileges, deprogram ourselves and our organizations and question and correct decision making, ownership and financing structures that do little to redress these imbalances in power, talent development and resources in our industry. Back in the 1990’s, some of us anti-racists in the New York hardcore punk scene had a saying: Treason to whiteness is loyalty to humanity. Word.

Let’s Discuss: How can we confront and address white supremacy on an individual level, by looking at our assumptions and biases, but also on an institutional basis, regarding who is making decisions, who is benefiting, and who is left out?

![]()

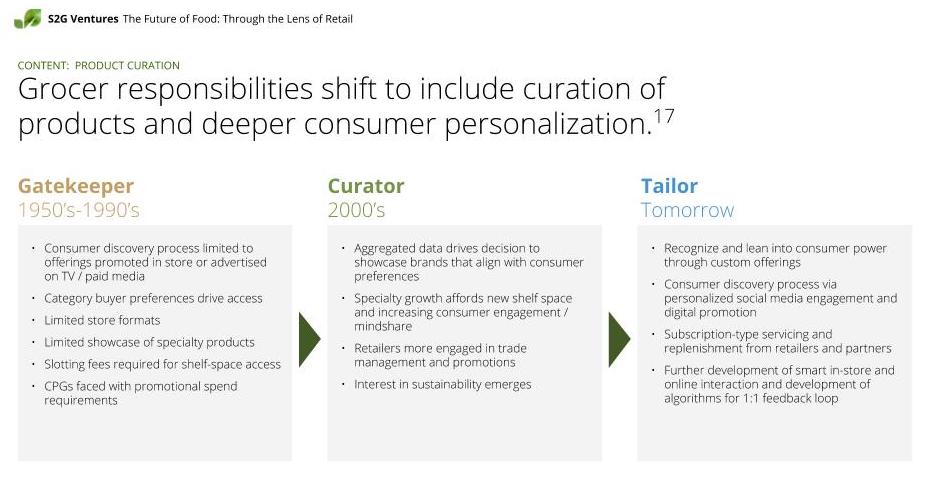

4. Values-based procurement

My chosen trade is retail purchasing and supply chain, and I’ve held these roles at the store, regional and national levels for a range of retailers. I am fortunate to have worked with companies that fought the good fight for ethical and mission-based procurement in the private sector, enabling the development and popularization of Organic, Non-GMO, Fair Trade, humanely-raised and sustainably caught products, categories and supply chains. Likewise, NGO’s working with the public sector have picked up these ideas and run with them, further refining the standards and applying them outside of the retail sectors where they could continue to grow and prosper.

Leading the way is the San Francisco-based Center for Good Food Purchasing , whose program “provides a metric based, flexible framework that encourages large institutions to direct their buying power toward five core values: local economies, environmental sustainability, valued workforce, animal welfare and nutrition.” (Disclosure: the author has volunteered with the Austin cohort since 2015).

The standards framework was inspired and influenced by private sector retail folks like myself, as well as community members, trade unionists and elected officials. While its primary use has been for school systems and other public and institutional contracts, the Center’s standards framework is just as relevant to other private sector actors in the supply chain who have not yet started to address these issues. As procurement becomes a hotter employment trend, procurement professionals will need to focus on more than just getting the best cost of goods or quick turnaround times that stress and exploit stakeholders downstream. They will need critical thinking skills and considerations of diversity and inclusion, and this values-based framework will make the roles accountable, holistic, and compelling as a career path in such a chaotic, crisis-prone food system.

The darker side of procurement is how much of the supply chain utterly failed to take into account ethical issues in supplier management during the pandemic. Every single worker death at a meat processing plant or produce operation was immediately followed by a purchase order from a retail or wholesale customer, whether they were mass market chains, natural food stores or smaller, specialty distributors. There were no ramifications in the supply chain for hundreds of deaths and thousands of illnesses, communities stressed and wrecked, families shattered. Business kept grinding on, workers kept getting sick and dying.

This isn’t the only way. The Coalition of Immokalee Workers, a Florida-based and farmer-led standards and advocacy organization, has negotiated legally binding contracts and codes of conduct with buyers that articulate clear penalties for growers who abuse their workers or create conditions that lead to sickness and death: the growers lose the business. According to a 10 year, longitudinal study by Harvard University, such worker driven initiatives are the most effective way to establish responsible supply chains, particularly by giving workers a seat at the table. Greg Asbed, co-founder of CIW, recently told me; “If you have a lot of purchasing power, you can demand more humane conditions, you can demand compliance with fundamental human rights in your suppliers’ operations, you can improve the lives of millions of people… if you decide to wield that same volume purchasing power for good as opposed to evil. All of this comes together to form an actual enforcement of the rights in the Fair Food Code of Conduct. That’s the power of the purchase order.”

Greg also laid it all out for us pretty starkly, “Whatever they call social responsibility in the food industry has been a joke, a fraud… it is absolutely empty and soulless and unreal. It is everything that has not worked and has been done for public relations purposes for the corporations, not the workers. That all became clear when Covid came down and all these outbreaks came to the press, did any of the buyers step up and say that we can’t allow this to keep happening? Not one.”

The frameworks and best practices for values-based procurement have already been stress tested, and it protects and empowers the stakeholders most prone to abuse otherwise while assuring the supply chains function optimally. We just need more retail and wholesalers to get with it.

Let’s Discuss: Values-based purchasing was birthed in the natural channel, but has been stalled and watered-down in the greater food industry. With its adoption growing in the public sector, how can we make these standards foundational to our whole food supply?

![]()

5. Worker ownership and a solidarity economy

Ownership and governance are two major hurdles for racial and economic justice in the food system. Fortunately, there is a movement afoot to diversify the wealth and decision making power for enterprises, and there is significant historical precedent and momentum. Worker ownership models, such as employee stock ownership plans (ESOP’s), worker cooperatives, employee owned trusts, perpetual trusts and multi-stakeholder cooperatives are becoming more popular, particularly among millennials and younger BIPOC workers who have been marginalized and exploited in traditional corporate environments. The benefits are many for all involved, including greater employee engagement, better company performance and better employee wellbeing and happiness, and are well documented across thousands of such enterprises. This includes familiar brands like Bob’s Red Mill, King Arthur Flour and Equal Exchange, or international icons such as The Mondragon Cooperative Complex and John Lewis UK. There are also dozens of scrappy startups involved with USFWC and NYC NOWC, values-driven businesses that are putting worker and community benefit at the core of their purpose. This should be a familiar clarion call to those of us in the natural products trade.

The financial considerations for employees are well documented, with household net wealth 92% higher for employee-owners than for non-employee-owners; employee-owners having 33 percent higher median income from wages; employee-owners are much more likely to have great benefits, including flexible schedules, retirement plans, access to childcare, parental leave, and tuition reimbursement; and employee-owners having substantially more job stability than non-employee-owners. The model is also spreading to the tech sector and flourishing among website and mobile app developers who are getting wise to the predatory and extractive practices of unicorn tech startups.

Many of the folks in this sector are looking beyond the atomized marketplace they must function in and building networks towards a solidarity economy, a 21st century version of the cooperative commonwealth that social reformers envisioned in the Gilded Age to overcome poverty, exploitation and racism by creating networks of like-minded enterprises that could supply and support each other. And in the shadow of the silver tsunami of baby boomer business owners facing retirement, Alternative Ownership Advisors, who recently helped Organically Grown Co. transition into a perpetual trust model, has articulated a set of legislation needs to enable the growth of the employee/worker owned sector, including tax incentives for business owners, incentives for capital providers to finance such enterprises and encouraging more states to allow these enterprise forms to legally incorporate.

How do we make worker and employee ownership norm?

These are just a few ideas that I’ve been noodling on recently. As someone who is pretty busy supporting a number of mission-driven retail, CPG and NGO enterprises, I have been privileged to keep a roof over my head and food in the pantry. I have had the time and energy on nights and weekends to consider the current crisis, research and articulate what we could do differently from here on out.

I know and love so many wonderful colleagues in natural products retail, supply chain and startup land who are committed, energetic and well-resourced to remake society towards justice, equity and sustainability. But I am also deeply anxious and skeptical that those of us who have stayed healthy, housed and employed will not anticipate and prepare for the next crisis, especially in solidarity with those on the frontlines that are bearing the highest costs. I am very concerned about the resistance we will face from vested interests, reactionaries and conspiracy theorists who can’t see past their own short term self-interest. Covid-19 is doing a lot of damage and we should consider it a preview of what’s to come. Climate change is here, and there will be no mask mandates or vaccine rollouts that can save us from the growing threats of wildfires, superstorms, rising sea levels, mold epidemics and ocean acidification. We can only imagine how these climatic events will drastically impact the folks who are already disempowered. We have yet to correct, resolve and heal from these power imbalances. There’s a shit ton riding on this and we have work to do.

Let’s Discuss: What are your learnings from this crisis and what is your commitment to building supply chains that are fair, just, sustainable and transparent?

Join us on February 4 for an interactive discussion on how retailers might better support all of their stakeholders needs around transparency, equity, diversity, health and sustainability with Errol Schweizer, Host of The Checkout Podcast, Co-Founder, Board Member For Natural Products Retail and CPG, Writer at Forbes.com and Former Whole Foods VP of Grocery, Sam Polk, CEO at Everytable, Gerardo Reyes Chavez, Coalition of Immokalee Workers, Greg Asbed, Co-Founder at Coalition Of Immokalee Workers, and Jessica Murphy, Business Development Manager at S2G Ventures.

Join us for future Redesigning Retail conversations here.

![]() Born and raised in The Bronx, Errol Schweizer brings more than 25 years of experience in the natural and organic food movement. Errol is a Board Member and Strategic Advisor for over a dozen food and retail brands, including Good Eggs, Merryfield, Farmer Direct Organic, Ka-Pop’s and Nuttzo. He is also a co-founder of Goodfish, Basics Market, Mood33, Herbl Distribution, and BeyondBrands, as well as Good Catch, a plant-based seafood analogue. Errol previously served as the Vice President of Grocery for Whole Foods Market, leading the merchandising, purchasing and product assortment for more than 80 categories and $5 billion in annual sales. His team enabled many progressive, innovative companies to become mainstream, including Vital Farms, Beyond Meat, Siggi’s and Saffron Road, as well as shepherding more than 10,000 items through Non-GMO Project Verification. Errol was named a retail game-changer by Supermarket News and received a Lifetime Advocacy Award from Hemp Industry Association. He is the co-founder and host of The Checkout Podcast, a show that centers the efforts of working class and BIPOC folks on the frontlines of our food system.

Born and raised in The Bronx, Errol Schweizer brings more than 25 years of experience in the natural and organic food movement. Errol is a Board Member and Strategic Advisor for over a dozen food and retail brands, including Good Eggs, Merryfield, Farmer Direct Organic, Ka-Pop’s and Nuttzo. He is also a co-founder of Goodfish, Basics Market, Mood33, Herbl Distribution, and BeyondBrands, as well as Good Catch, a plant-based seafood analogue. Errol previously served as the Vice President of Grocery for Whole Foods Market, leading the merchandising, purchasing and product assortment for more than 80 categories and $5 billion in annual sales. His team enabled many progressive, innovative companies to become mainstream, including Vital Farms, Beyond Meat, Siggi’s and Saffron Road, as well as shepherding more than 10,000 items through Non-GMO Project Verification. Errol was named a retail game-changer by Supermarket News and received a Lifetime Advocacy Award from Hemp Industry Association. He is the co-founder and host of The Checkout Podcast, a show that centers the efforts of working class and BIPOC folks on the frontlines of our food system.

The post 5 Actions to Reboot Food Retail appeared first on Food+Tech Connect.

Audre Kapacinskas, Vice President at S2G Ventures

Audre Kapacinskas, Vice President at S2G Ventures

Born

Born

Tonya Bakritzes is SVP of Marketing at S2G Ventures where she oversees the fund’s brand strategy, marketing and communications and provides strategic guidance to the fund’s portfolio companies.

Tonya Bakritzes is SVP of Marketing at S2G Ventures where she oversees the fund’s brand strategy, marketing and communications and provides strategic guidance to the fund’s portfolio companies.

Arthur Chow is a Vice President at S2G Ventures. He is focused on the evaluation and execution of potential investments as well as serving the needs of portfolio companies.

Arthur Chow is a Vice President at S2G Ventures. He is focused on the evaluation and execution of potential investments as well as serving the needs of portfolio companies.